GreenPower Motor Company (TSE: GPV) (NASDAQ: GP) is a manufacturer and distributor of all-electric buses. The company offers electric-powered transit buses that deploy electric drive and battery technologies with a lightweight chassis and low-floor body.

Earnings Continue to Disappoint

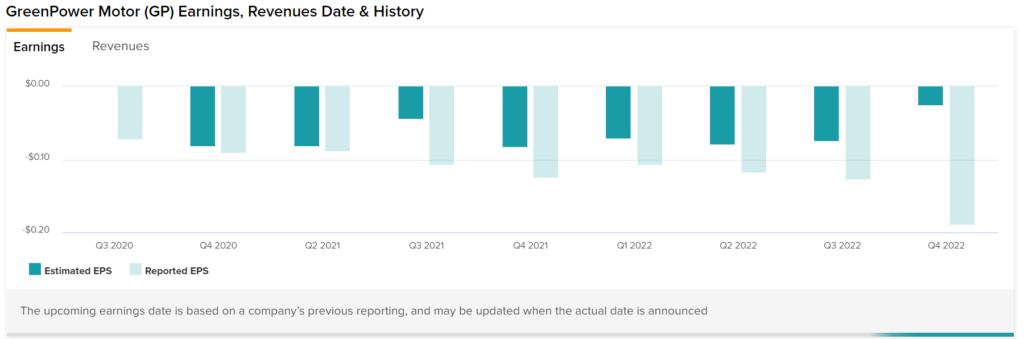

The company recently reported earnings for its fourth quarter of Fiscal Year 2022. Earnings per share came in at -$0.19, which was very much below analysts’ consensus estimate of -$0.03. In the past nine quarters, GreenPower has missed estimates each time.

In addition, sales decreased 1.46% year-over-year, with revenue hitting $4.314 million compared to $4.378 million. It appears that the revenue decline was primarily attributed to purchase decisions that were put on hold as customers awaited federal funding.

Unfortunately, GreenPower’s gross profit was almost cut in half, which means that the company wasn’t able to maintain its profitability despite relatively flat revenue.

Indeed, its gross profit margin contracted from 26.7% to 13.8%. The stock opened about 2.4% lower today, but it finished the day unchanged, recovering its losses.

Insider Activity is Bearish

When looking at insider activity, there doesn’t seem to be a lot of confidence from within. There has been much more selling than buying, even as the price fell. This suggests that insiders don’t believe the stock is undervalued yet.

As a result, TipRanks’ Insider Confidence signal for GreenPower Motor is negative, which is below the sector’s average of neutral.

Analyst Recommendations

Analysts have not put out a recommendation within the past three months. However, five-star analyst Tate Sullivan from Maxim Group had placed a Buy rating four months ago, with a price target of $14 per share. The same can be said for 4.5-star analyst Craig Irwin from Roth Capital, who assigned a $13 price target five months ago.

Although these estimates are probably outdated, it’s worth mentioning that GreenPower Motor’s future prospects have mostly remained intact. Thus, it’s likely that an updated analyst forecast might still be higher than the current share price, which has fallen significantly in the past four to five months.

Final Thoughts

GreenPower saw a weak quarter, as its revenue slightly declined while earnings came in worse than expected. As a result, insiders don’t appear confident enough to invest additional money into the company.