Fintech stock Green Dot (NYSE:GDOT) rolled out the latest set of projections for its 2023 earnings, and investors promptly fled the stock. They took over 34% of Green Dot’s market cap with them in Friday afternoon’s trading as the numbers are shaping up worse than originally expected.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The latest news is troubling to say the least. Green Dot revealed that it expects adjusted earnings for 2023 to come in between $1.62 and $1.69 per share. Given that analyst consensus looked for $1.85, that’s certainly bad news. Worse, the previously projected range from Green Dot would have been in line with estimates, between $1.80 and $1.90. Adjusted revenue fared only slightly better, as it increased the range from $1.376 billion to $1.462 billion to between $1.465 billion and $1.48 billion.

Green Dot’s CFO, Jess Unruh, noted that the quarter did prove to be below expectations, but it’s been rapidly working to improve its efficiencies and produce growth accordingly. Most of the issues seemed temporary, including issues of conversions and regulatory matters, as well as some “customer disputes.” Indeed, news of Green Dot’s customer disputes stretches back to at least last August, when a range of customers noted trouble accessing their funds. That latest set of troubles came after a class-action suit that targeted similar problems and also brought Green Dot under investigation by the U.S. Senate.

What is the Price Target for Green Dot Stock?

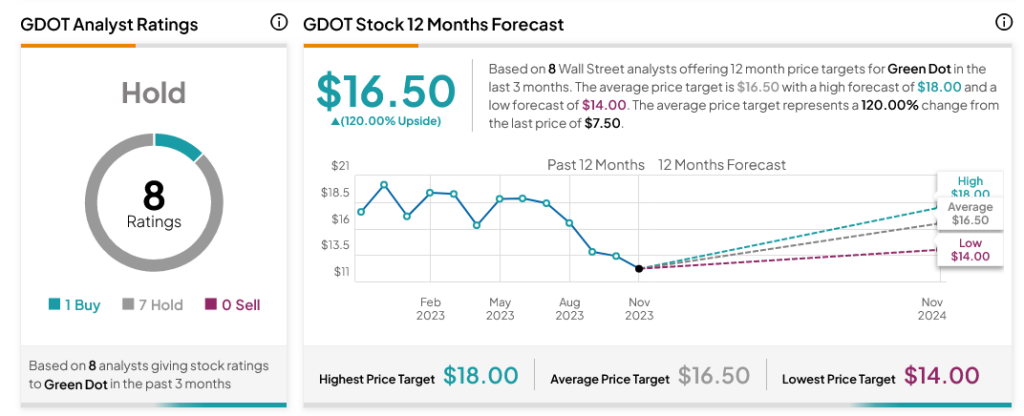

Turning to Wall Street, analysts have a Hold consensus rating on GDOT stock based on one Buy and seven Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average GDOT price target of $16.50 per share implies 120% upside potential.