Shares of GoPro spiked 15.7% on Friday after the wearable action camera maker’s 3Q adjusted earnings of $0.20 came ahead of the consensus estimates of $0.06 per share. EPS flipped from a year-ago loss of $0.42 per share. Revenues of $280.5 million jumped 114% year-over-year and exceeded analysts’ expectations of $234.5.

GoPro’s (GPRO) subscribers surged 65% from the year-ago quarter to 501,000. Gross margin expanded to 36.2% in 3Q from the year-ago margin of 23.4%. Adjusted EBITDA generated $39 million, compared with a loss of $53 million in the year-ago period.

GoPro’s CEO Nicholas Woodman said “Thanks to consistent momentum throughout the quarter and the strong launch of HERO9 Black coupled with our GoPro subscription service, in Q3 GoPro achieved GAAP and non-GAAP profitability, generated $100 million of operating cash flow, and surpassed 500,000 subscribers.” GoPro’s CFO Brian McGee added that “In Q3 2020, our direct-to-consumer and subscription-centric strategy expanded margin, increased subscribers and significantly lowered our operating expenses.” (See GPRO stock analysis on TipRanks).

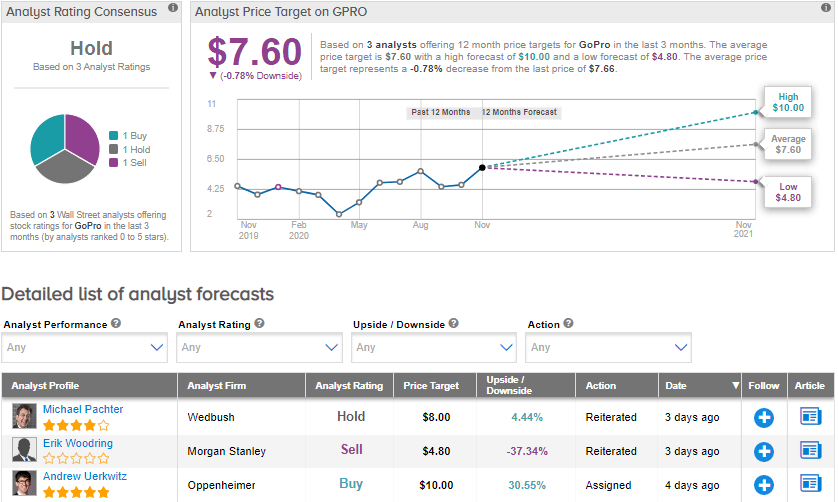

Following the robust 3Q results, Wedbush analyst Michael Pachter raised his price target to $8 (4.4% upside potential) from $6, “given the higher-margin profile of GoPro’s DTC business.” He said “GoPro delivered its most profitable third quarter results since 2017. After recently shifting its business model toward a direct-to-consumer strategy, GoPro has found early success.”

Pachter further added “GoPro’s latest product pricing compels the purchaser to buy direct and to get an annual subscription, providing GoPro with a significantly lower barrier to profitability. Its product lineup expands further into a broader range of applications, including its applicability to content streamers.” The analyst said that “Given the rapid growth in this market, GoPro can potentially expand its core user base.” He, however, maintained a Hold rating on the stock as shares are trading near his target.

Currently, the Street is sidelined on the stock with a Hold rating. With shares up a whopping 76.5% year-to-date, the average price target of $7.60 implies that the stock is more than fully priced at current levels.

Related News:

Dropbox Shares Fall 5% Despite Beat and Raise Quarter

Glu Mobile Posts Record-Breaking Revenue; Shares Up 27%

Uber Posts Worse-Than-Feared Loss On Weak Rides Demand; Wedbush Raises PT