Shares of global investment banking and financial services firm Goldman Sachs Group (NYSE: GS) are up over 4% during the pre-market trading session at the time of writing. The firm posted significantly better-than-expected second-quarter results on both the earnings and revenue fronts.

Year-to-date, GS grabbed the number one spot in worldwide announced and completed mergers and acquisitions (M&A), and in worldwide equity and equity-related offerings and common stock offerings.

Furthermore, the firm even hiked up its quarterly cash common dividend to $2.50 per share to be paid in the third quarter, reflecting a dividend yield of 3.4%.

Q2 Results Exceed Expectations

GS reported diluted earnings of $7.73 per share, meaningfully outpacing the analysts’ estimates by $1.04 per share. However, the figure is lower both sequentially and compared to Q2FY21, when it reported diluted earnings of $15.02 per share.

Notably, net revenues of $11.86 billion came in much higher than analyst estimates of $10.7 billion. However, revenues fell 23% year-over-year and 8% sequentially.

Meanwhile, net revenues in the Investment Banking segment fell 41% due to an industry-wide slowdown in both equity and debt underwriting, compared to the prior year’s quarter when these activities were witnessing a peak.

Nonetheless, net revenues in Global Markets gained 32% year-over-year, benefitting from strong performances in both Fixed Income, Currency and Commodities (FICC), and Equities, particularly in financing.

Moreover, net revenues in the Consumer & Wealth Management segment also jumped 25% year-over-year, reflecting higher assets under management, higher loans and deposits, and higher credit card balances.

However, net revenues in the Asset Management business declined 79% year-over-year, driven by net losses in Equity investments and significantly lower net revenues in Lending and Debt investments.

During the quarter, the firm repurchased $500 million worth of common stock and paid dividends worth $719 million.

The Street is Cautious about GS

Based on nine Buys and four Holds, the Wall Street community is cautiously optimistic about GS stock with a Moderate Buy consensus rating. The average Goldman Sachs price forecast of $373.91 implies 27.2% upside potential to current levels. Meanwhile, the stock has lost 24.8% year to date.

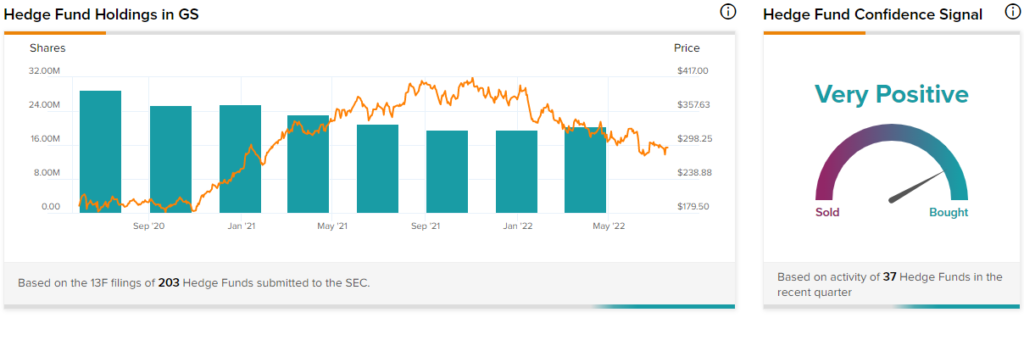

Hedge Funds Are Bullish about GS

According to the TipRanks Hedge Fund Trading Activity tool, confidence in Goldman Sachs is currently Very Positive, as 37 hedge funds increased their cumulative holdings of GS stock by 931,800 shares in the last quarter.

Concluding Notes

Goldman Sachs’ results provided a breather to the constant earnings miss reported by other big banks. Although the bank’s performance has declined both sequentially and year-over-year, better-than-expected earnings results surely provide much-needed comfort and confidence to shareholders in the dwindling market scenario. The bank has also shown its continued commitment to shareholders by raising its common dividend by 25%.