Investment bank Goldman Sachs (NYSE:GS) has agreed to pay $215 million to settle a long-running class action lawsuit that was considered one of the most high-profile cases against alleged discrimination and unequal treatment of women at workplaces. The settlement will allow the bank to avoid a trial that was scheduled for next month in a New York federal court.

The lawsuit, which involved about 2,800 associates and vice-presidents, mainly in the investment banking and securities divisions, accused the bank of policies and practices that gave women weaker performance reviews, impacting their career growth. The lawsuit also alleged that Goldman was systematically paying women less than men.

As part of the settlement, Goldman has agreed to hire independent experts to perform additional analysis on performance evaluation practices and gender pay gaps. The bank will also implement better communication practices at the vice-president level regarding career development and promotion criteria.

“After more than a decade of vigorous litigation, both parties have agreed to resolve this matter,” said Jacqueline Arthur, Goldman Sachs’ global head of human capital management. Arthur also assured that the bank is committed to ensuring a “diverse and inclusive workplace” for its employees.

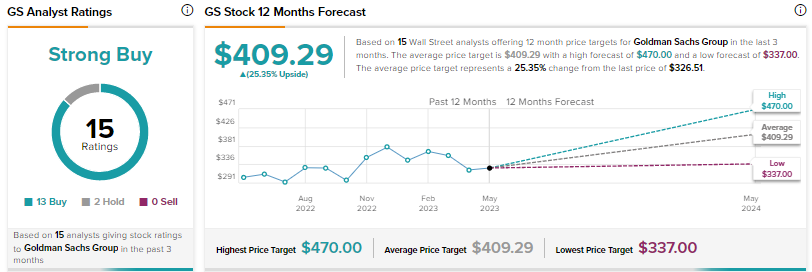

What is the Price Target for GS Stock?

Wall Street’s Strong Buy consensus rating on Goldman Sachs is based on 13 Buys and two Holds. The average price target of $409.29 implies 25.4% upside. Shares are down about 5% year-to-date.