Golden Nugget Online Gaming (GNOG) is an American online casino and sports betting company serving more than five million customers. It originally operated traditional casino outlets, opening its first location in 1946.

Let’s take a look at the company’s latest financial performance, corporate updates, and newly added risk factors. (See Analysts’ Top Stocks on TipRanks)

Q2 Financial Results

Golden Nugget Online Gaming reported a 27.7% year-over-year increase in revenue to $31.7 million for Q2 2021, beating the consensus estimate of $30.3 million. It posted a loss per share of $0.13, missing the consensus estimate of a loss per share of $0.11.

Corporate Updates

Golden Nugget Online Gaming has been awarded a license to offer online sports betting in Arizona. The company has partnered with Grand Canyon Resort Corporation to offer online betting built around Hualapai Tribe events.

The company has entered into an agreement with Dayton Real Estate Ventures to provide it access to the Ohio market. Golden Nugget Online Gaming estimates that Ohio’s online casino market may be worth more than $1 billion.

Golden Nugget Online Gaming has agreed to be acquired by DraftKings (DKNG) for $1.56 billion in an all-stock transaction. The transaction is expected to close in Q1 2022.

Risk Factors

The new TipRanks Risk Factors tool shows 55 risk factors for Golden Nugget Online Gaming. Since June 2021, the company has updated its risk profile with four new risk factors, all related to its pending acquisition by DraftKings.

Golden Nugget Online Gaming cautions that there is no guarantee that it will be acquired by DraftKings, partly because of the required regulatory approvals. It says that failure to close the deal may affect its business and stock price unfavorably. The company says it may forgo certain business opportunities while waiting to close the transaction.

Golden Nugget Online Gaming warns that it may be required to pay $55 million in termination fees to DraftKings if the merger agreement collapses under certain circumstances. For example, that may happen if the company decides to ditch the agreement with DraftKings to pursue an alternative deal.

The majority of Golden Nugget Online Gaming’s risk factors fall under the Finance and Corporate category, with 42% of the total risks. GNOG stock price has declined about 12% year-to-date.

Analysts’ Take

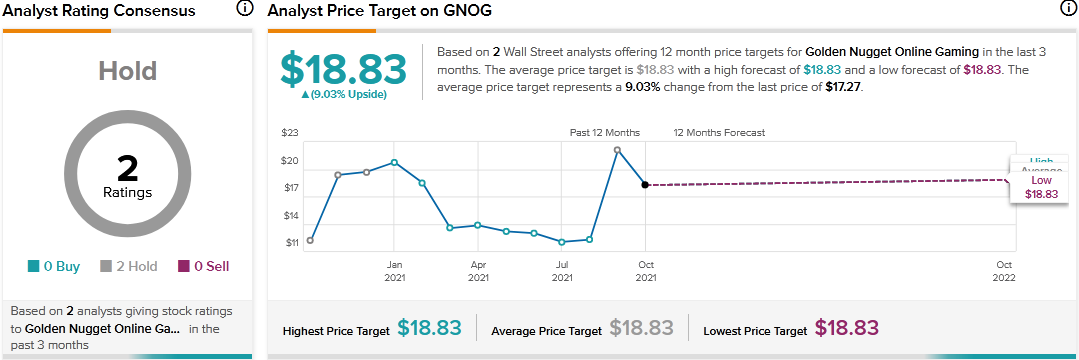

After Golden Nugget Online Gaming announced that it agreed to be acquired by DraftKings, Benchmark Co. analyst Mike Hickey downgraded GNOG stock to a Hold from a Buy. Hickey did not assign the stock a price target.

Consensus among analysts is a Hold based on 2 Holds. The average Golden Nugget Online Gaming price target of $18.83 implies 9.03% upside potential to current levels.

Related News:

Rogers Acquires Silicone Engineering

Thor Industries Rewards Shareholders with 5% Dividend Hike

Phillips 66 Hikes Dividend By 2%; Shares Rise 3.6%