“I like people who roll up their sleeves and do real work,” said Ryan Cohen, director of GameStop (NYSE:GME), game retailer and occasional meme stock. That doesn’t bode well for GameStop executives, described in a Seeking Alpha article as “overpaid” and “serial delegators.” It also didn’t sit well with investors, who pulled the rug out from under GameStop and sent share prices down in Thursday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Cohen took to the stage at GameStop’s annual shareholder meeting on Tuesday, railing against his executive classes, who weren’t even willing to buy shares in their own company. That’s a point that can’t be said of Cohen, certainly; Cohen, just days ago, bought roughly $10 million worth of stock in one fell swoop. Though Cohen’s remarks only took a minute, he emphasized that he was working to turn GameStop around. As GameStop’s largest shareholder, with 12.1% of the total stock in his own portfolio, Cohen has quite a bit of weight in the company.

Cohen will have something of an uphill battle. Just last week, GameStop’s CEO, Matt Furlong, was ejected by the board. Furlong was the fifth CEO to serve in GameStop in the last five years, a move that left rampant demoralization in its wake. GameStop’s earnings report certainly didn’t help, with a bigger loss than even analysts saw coming, revenue that was down 10.1% against the same time last year—and also faltered against analyst expectations—and an ongoing game of “Musical Chairs” going on in the C-suite.

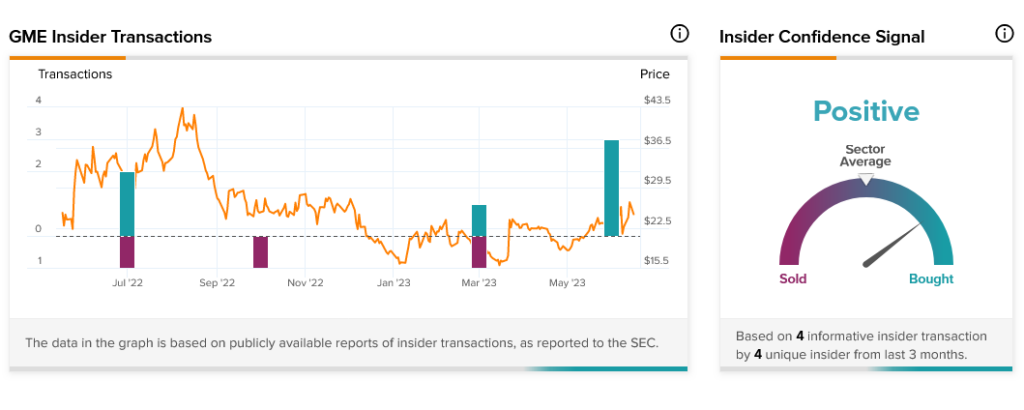

Yet, thanks in large part to Cohen’s massive purchase, insider trading at GameStop suggests potential positive developments to come. In fact, thanks to that buy—along with a few others—sentiment at GameStop is considered “Positive.” When insiders buy $10.4 million in shares over the last three months—even when only one investor buys $10 million in one go—that “positive” makes some sense.