Investors rushed to pile up on Nikola shares as the company teamed up with General Motors to build electric pickup trucks and fuel cell commercial vehicles.

Shares in Nikola (NKLA) surged 41% at the close on Tuesday, and GM jumped 7.9%. As part of the partnership, GM will get a 11% stake in Nikola valued at about $2 billion.

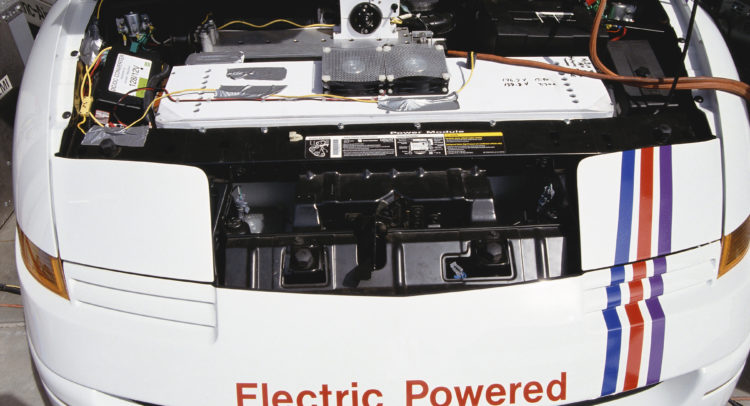

In exchange for the Nikola shares, GM (GM) will provide Nikola with batteries, fuel cell systems and a factory to build its Nikola Badger pickup. The Badger is anticipated to start production by year-end 2022.

“This strategic partnership with Nikola, an industry leading disrupter, continues the broader deployment of General Motors’ all-new Ultium battery and Hydrotec fuel cell systems,” said GM CEO Mary Barra. “We are growing our presence in multiple high-volume EV segments while building scale to lower battery and fuel cell costs and increase profitability. In addition, applying General Motors’ electrified technology solutions to the heavy-duty class of commercial vehicles is another important step in fulfilling our vision of a zero-emissions future.”

GM expects to gain more than $4 billion of benefits between the equity value of the shares, contract manufacturing of the Badger, supply contracts for batteries and fuel cells, and electric vehicle (EV) credits retained over the life of the contract. The automaker will be the exclusive supplier of fuel cells globally (outside of Europe) to Nikola for class 7/8 trucks.

Nikola said it anticipates to save over $4 billion in battery and powertrain costs over 10 years and over $1 billion in engineering and validation costs.

Since Nikola went public on June 4 via a merger with VectoIQ, the stock soared from below $15 before the deal was announced to $50.05 at the close on Tuesday. Shares in the company, which plans to manufacture hydrogen-electric trucks but has not yet produced or sold any vehicles, have plunged 37% over the past 3 months. (See NKLA stock analysis on TipRanks)

Wedbush analyst Daniel Ives called the deal a “paradigm changer” for Nikola with regard to its future EV and fuel cell ambitions.

“There have been many skeptics around Nikola and its founder Trevor Milton’s ambitions over the coming years, which now get thrown out the window with stalwart GM making a major strategic bet on Nikola for the next decade on the EV and fuel cell front,” Ives wrote in a note to investors. “For GM given its strategic goal around EV battery technology for the coming years and its massive $20 billion of investments earmarked for electric and autonomous vehicles by 2025, we view this as a smart strategic bet at the right time.”

For now Ives sticks to his Hold rating on NKLA with a $45 price target, saying that even with this news, there “still remains an execution story over the coming years”.

NKLA has 5 analysts covering the stock, who are divided between 2 Buy ratings and 3 Hold ratings adding up to a Moderate Buy consensus. The $53.75 average price target puts the upside potential in the shares at 7.4% over the coming year.

Related News:

General Motors Plans To Jointly Develop Cars With Honda

Nio August Car Deliveries More Than Double

General Motors’ Electric Vehicle Spin off a “No Brainer,” Says Analyst