Investment house Washington H. Soul Pattinson (AU:SOL), popularly called WHSP, announced a non-binding, indicative bid of A$3.06 billion to acquire Australian fund manager Perpetual Ltd. (AU:PPT). The potential takeover news came after trading closed today and followed Perpetual’s announcement about breaking up its three core units. However, Perpetual’s board rejected the offer after careful review, as it believes the proposal undervalues the company’s businesses. PPT stock gained 6.3%, while SOL shares rose 1.4% on the news.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Perpetual is a diversified financial services company offering specialized investment management, wealth advice, and corporate fiduciary services to individuals, families, financial advisers, and institutions. Meanwhile, WHSP is an Australian investment company with investments in a diverse portfolio of assets across various industries.

Details of WHSP’s Takeover Bid

WHSP’s bid was made on November 21, representing a premium of 28.6% on the closing price of November 13 and a 13.6% premium to today’s closing price. Notably, WHSP is Perpetual’s largest shareholder, with a 9.9% stake.

WHSP had welcomed Perpetual’s decision to strategically break down its three units. As per the bid, WHSP would have full ownership of Perpetual’s wealth management and corporate trust businesses. At the same time, its asset management unit would be spun off and the listed shares would be distributed back to the existing shareholders. This would ensure that Perpetual’s shareholders benefit fully from the transaction.

The proposal entails issuing A$1.06 billion in SOL equity to Perpetual shareholders. The remaining A$2 billion would be distributed in the spin-off offering. Perpetual confirmed that the proposal is being reviewed by the Board.

Is Perpetual a Good Buy?

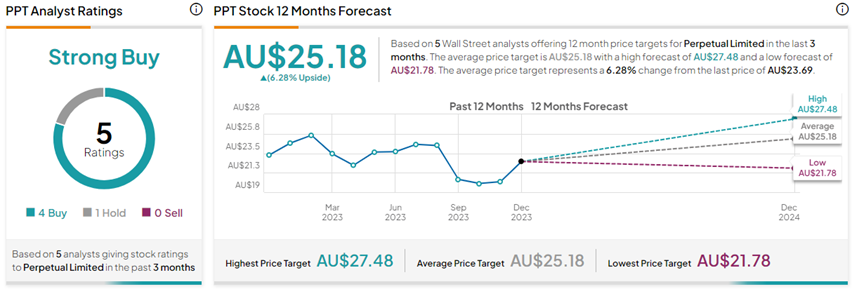

With four Buys and one Hold rating, PPT stock commands a Strong Buy consensus rating on TipRanks. The Perpetual share price prediction of A$25.18 implies 6.3% upside potential from current levels. PPT shares have lost 3.3% so far this year.