Pilbara Minerals Limited (AU:PLS) and Core Lithium (AU:CXO) are two mineral companies from Australia that have gained huge momentum due to the growing adoption of lithium. Pilbara is better placed because it has multiple advantages, like a large scale of operations, low-cost production, and a solid cash flow. On the other hand, Core Lithium has yet to start its production at full scale and is already facing headwinds with a decline in lithium prices.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

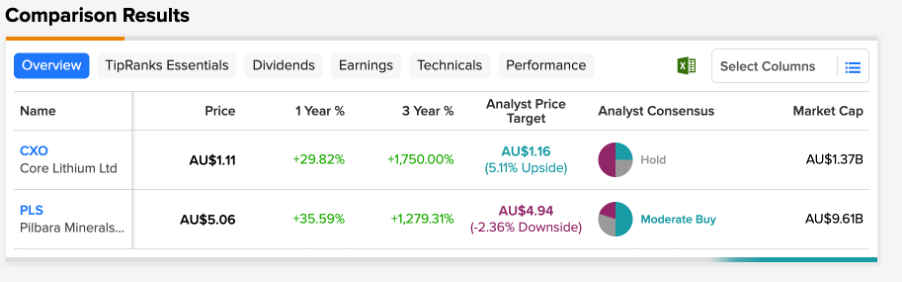

We have used the TipRanks Stocks Comparison tool to compare these two stocks from the basic materials sector. This tool allows investors to analyze the stocks and compare them on various parameters.

Let’s have a look at the details.

Core Lithium Limited

Based in Australia, Core Lithium is focused on lithium, copper, zinc, and lead projects. The company is focused on building a project base in diversified metals.

The company’s stock has generated a more than 2500% return in the last three years and reached an all-time high in November 2022. Since then, the stock has fallen by 25%. This was after Goldman Sachs issued a bearish research report on the lithium sector.

The company is betting big on its Finniss Lithium Project in the Northern Territory, Australia. This is among the most efficient projects in terms of capital, infrastructure, and overall logistics. Under this project, the company is producing spodumene, which is one of the most important lithium mineral sources. Core Lithium has already recorded its first sale from the project. In 2023, the company will develop new mining areas at Finniss, and 20 new target areas have been identified.

On the other hand, many analysts anticipate increased production risk in its Finniss project, as well as a drop in lithium prices in 2023. This is mainly due to surplus supply amid a slowdown in demand from China.

Moving forward, overall higher lithium demand will support the company’s share price, with minor setbacks from economic conditions.

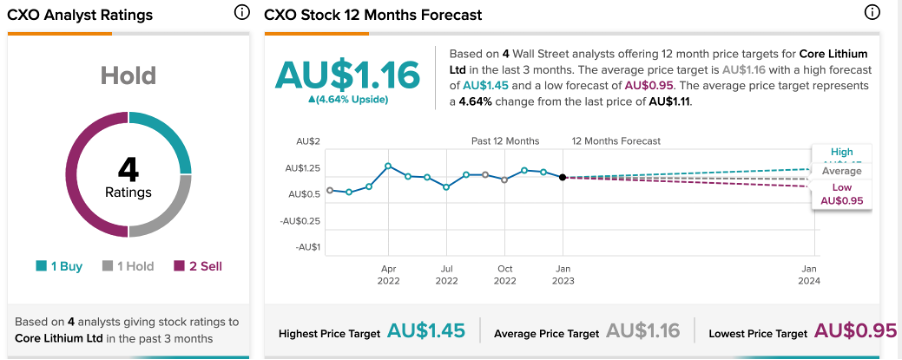

Is CXO a Good Buy?

According to TipRanks, CXO stock has a Hold rating at an average target price of AU$1.16. The target price is 4.6% higher than the current level. It has a high forecast of AU$1.45 and a low forecast of AU$0.95.

Pilbara Minerals Limited

Pilbara is a leading player in the lithium sector and owns and operates the Pilgangoora Project in Australia. Under this project, the company produces spodumene and tantalite concentrates of high quality.

Pilbara is among analysts’ favorites in the sector due to the scale and profitability of its operations. The Pilgangoora project is known for its vast scale and efficiency in terms of cost. This gives the company an advantage in navigating the period of falling lithium prices.

In its annual results for 2022, the company posted a huge 577% increase to AU$1.2 billion, along with an operating profit after tax of AU$562 million. The company’s spodumene shipments have increased by 28% over the previous year. The company also launched Battery Material Exchange (BMX), which is a platform for trading spodumene concentrate. With this, it is able to benefit from much higher prices through auctions.

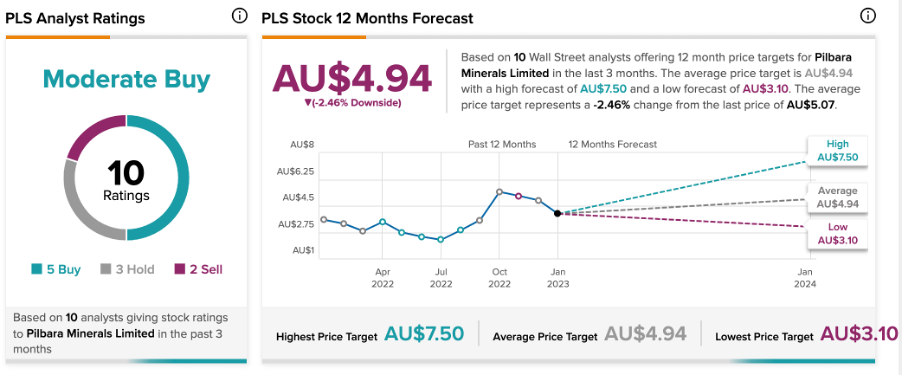

Pilbara Minerals Share Price Forecast

The company’s stock has gained almost 80% in the last six months.

According to TipRanks’ analyst consensus, Pilbara’s stock has a Moderate Buy rating, based on five Buy, three Hold, and two Sell recommendations.

The PLS target price is AU$4.94, which is 2.45% lower than the current level.

Ending Notes

With the changing landscape of the automobile industry, both production and consumption are shifting toward electric vehicles (EVs). In this process, lithium has emerged as the star of this growth cycle. Lithium as a metal has superior properties, which makes it ideal for making batteries.

As a result, currently, the lithium sector is creating a lot of excitement for analysts as well as investors. The market has its share of ups and downs, but the long term is profitable.

Among the lithium players, analysts are more bullish on Pilbara’s stock, while they have a Hold rating for Core Lithium. They feel that with its large scale of operations and lower cost advantages, Pilbara is an attractive pick.

Join our Webinar to learn how TipRanks promotes Wall Street transparency