Shares of FTSE 100-listed Vodafone Group plc (GB:VOD) were up nearly 2% in early trade this morning after a Bloomberg report suggested that Swisscom AG (DE:SWJ) is interested in buying the company’s Italian operations. The parties are said to be discussing a potential deal, details of which remain unknown at this time. The deal could be announced as early as January.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Vodafone Group is a British telecommunications company that provides a range of services, including voice, messaging, and internet connectivity, for both fixed and mobile networks. Its operations span across 21 countries, with services spread in Asia, Africa, Europe, and Oceania.

Potential Deals for Vodafone’s Italian Operations

On December 18, France-based telecom firm Iliad SA confirmed its discussions with Vodafone to combine Vodafone Italia and Iliad Italia and form a telecom behemoth in the country.

Meanwhile, Swisscom AG is a leading telecom service provider in Switzerland, with a 51% government holding. It has a significant market share in mobile, broadband, and TV telecom in Switzerland. As per reports, Swisscom plans to combine its Italian broadband carrier Fastweb Spa with Vodafone’s Italian mobile operations. To gain shareholder support and be competitive, Swisscom’s deal will have to be higher and more synergetic than rival Iliad’s €10.45 billion bid.

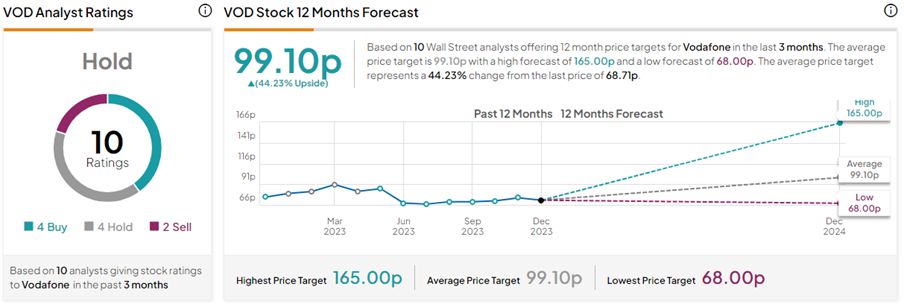

Amid the lucrative offers for Vodafone’s Italy unit, let’s take a look at analysts’ ratings for the company.

Is Vodafone a Buy, Sell, or Hold?

Following Iliad’s merger offer, Barclays analyst Maurice Patrick maintained a Hold rating on the stock with a price target of 92.00p (33.9% upside).

On TipRanks, VOD stock has a Hold consensus rating based on four Buys, four Holds, and two Sell ratings. The Vodafone Group share price forecast of 99.10p implies 44.2% upside potential from current levels. Year-to-date, VOD shares have lost 9.5%.