Using the TipRanks Daily Analyst Rating tool for Italy, we have screened three banking stocks that were re-rated as Buy yesterday. According to analysts, these stocks not only have Buy ratings but also show significant upside potential for future share price growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

UniCredit SpA (IT:UCG), Intesa Sanpaolo S.p.A. (IT:ISP), and Banco BPM S.p.A. (IT:BAMI) are among the leading banks in Italy and also have a strong presence in Europe. Amid the rising interest rate environment, these stocks have rewarded their shareholders generously. Moving forward, analysts maintain a bullish stance and anticipate the trend to continue in the future.

The Daily Analyst Rating tool compiles a list of recently rated stocks by analysts within a specific market. This tool assists users in identifying stocks favored by analysts, enabling them to make well-informed decisions.

UniCredit SpA

Italian commercial bank UniCredit is a leading financial institution in Italy with operations spread across Europe. Despite the bank’s stock surging by a substantial 168% in the past year, analysts maintain a bullish outlook, expecting further growth in its price.

Yesterday, analyst Ignacio Cerezo from UBS confirmed his Buy rating on the stock, predicting a huge upside of more than 50% in the share price. Cerezo is highly bullish on the stock and also raised his price target on the stock from €31.5 to €34.0.

Overall, UCG stock has a Strong Buy rating backed by all 11 Buy recommendations. The average price forecast is €27.41, which is 23.4% above the current trading levels.

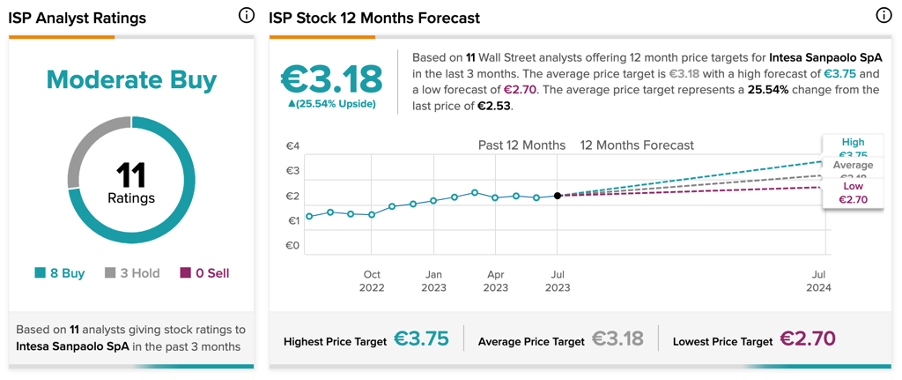

Intesa Sanpaolo S.p.A.

Intesa Sanpaola is another European bank based in Italy. The bank’s stock has gained more than 60% in the last year, driven by higher interest rates.

Cerezo is also bullish on this stock and confirmed his Buy rating yesterday. His price target of €3.5 predicts a growth of 39% in the share price.

According to TipRanks’ analyst consensus, ISP stock has a Moderate Buy rating based on eight Buy and three Hold recommendations. At an average price target of €3.18, analysts predict over 25% growth in the share price.

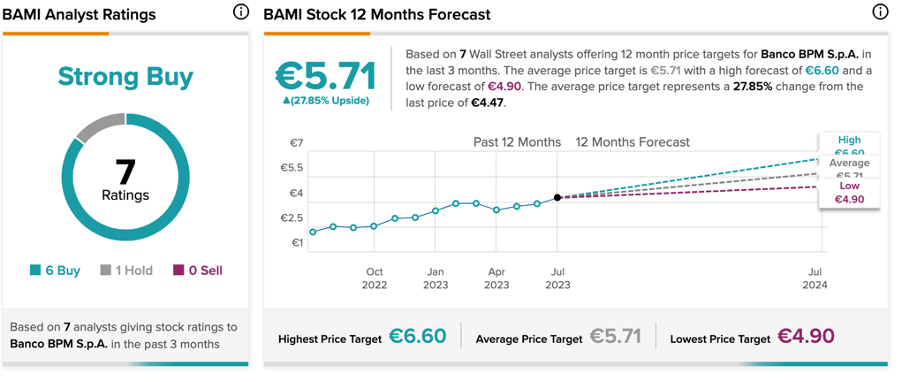

Banco BPM S.p.A.

Over the past year, Banco BPM shares have surged by 100%, resulting in an impressive 250% return over the longer three-year period.

Yesterday, UBS analyst Adele Palama maintained his Buy rating on the stock and also raised the price target from €5.0 to €5.5. This now implies an upside potential of 22.8% in the share price.

On TipRanks, BAMI stock has a Strong Buy rating backed by six Buy and one Hold recommendations. Analysts are predicting an increase of 27.6% at an average price forecast of €5.71.