The healthcare industry’s stocks have been famous among investors for a long time now for their defensive nature. The COVID-19 pandemic has put some more shine on these stocks. With the increased government funding and technological advancements in the sector, analysts see a huge opportunity for growth.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

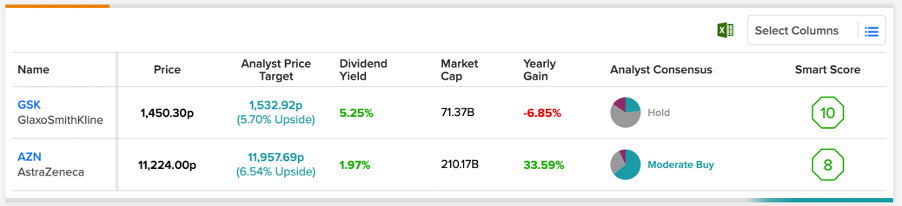

We have chosen two big names from the UK healthcare sector: GlaxoSmithKline (GB:GSK) and AstraZeneca (GB:AZN). These players are market leaders and known for a wide range of product lines.

These stocks also have a “Perfect 10” on the TipRanks Smart Score tool. This score suggests the company’s potential to beat the market’s returns over a period of time, with 10 being the highest.

Let’s have a closer look at them.

GlaxoSmithKline

GlaxoSmithKline (GSK) is known for its wide range of vaccines across the world, and it delivers around 2 million doses every day.

The company’s stock is currently on a downward trajectory and has fallen around 16.8% in the last six months. The company is facing certain challenges due to its clinical failure in Oncology and being the late entrant in the COVID-19 vaccines. Needless to say, this was clearly reflected in its share prices.

This has pushed the dividends for the company to a yield of 5.25% as compared to the industry average of 1.49%.

The company’s vaccine sales outlook is strong with the existing high demand and further geographical expansion. The vaccine sales are expected to increase by a mid-high teen percentage for the full-year results in 2022. The pipeline includes an upcoming vaccine for the respiratory syncytial virus, which will be the first in the market. Also, the revenue for Shingrix, one of its best-sellers, is expected to generate double-digit growth in 2022.

GSK Share Price Target

According to TipRanks’ analyst consensus, GSK stock has a Hold rating. The stock has wide coverage from analysts with a total of 13 recommendations.

The GSK target price is 1,532.92p, which is 5.7% higher than the current price level. The price has a high forecast of 1,700p and a low forecast of 1,300p.

AstraZeneca

The global pharmaceutical company, AstraZeneca, gained a lot of attention with its successful launch of COVID-19 vaccines. This also made the shareholders happy, as the stock generated a massive 58% return in the last three years.

In its third-quarter results for 2022, the company saw various regulatory approvals for its drugs along with stronger sales from its cancer and diabetes products. Since its first-half results, the company received 19 approvals in major markets.

The total revenue increased by 37% to $33.1 billion, with a 24% growth in oncology products. The company’s well-known cancer drugs like Calquence and Imfinzi witnessed revenue growth of 60% and 19%, respectively.

Based on strong sales numbers, the company increased its earnings guidance for the full year. The company now expects the high twenties to low thirties percentage growth in its EPS. Revenue is expected to rise by a low-twenties percentage point.

Is AstraZeneca a Buy Now?

According to TipRanks’ rating consensus, AstraZeneca stock has a Moderate Buy rating.

The average target price is 11,957.7p, which represents a growth of 6.5% on the current price level. The price target has a high forecast and a low forecast of 17,500p and 6,950p, respectively.

Conclusion

UK healthcare stocks offer a safe investment opportunity for investors, considering their huge global presence, a strong portfolio of drugs/vaccines, and the defensive nature of the stocks.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.