An expert’s advice is all we need during any uncertainty. The same is happening in the stock markets around the world. This is the time when the stock ratings from analysts can guide investors in a better way than their own research. With their expertise in the sector, it’s best to follow their lead to build the portfolio.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Today, we have picked two companies, Singapore Technologies Engineering (SG:S63) and ComfortDelGro Corporation Limited (SG:C52) based in Singapore, that have ‘Buy’ ratings from the analysts.

Let’s discuss these stocks in detail.

Singapore Technologies Engineering Ltd.

As a provider of technology and engineering solutions, the company caters to various sectors such as aerospace, defense, marine, public health, and more. The company’s diverse range of operations, combined with its innovative nature, makes it one of the most intriguing companies on the SGX.

Firms like CLSA, Maybank, Credit Suisse, and CGS-CIMB reiterated their Buy ratings on the stock after it declared its third-quarter results. Citigroup, on the other hand, took a cautious approach due to rising cost inflation and rated the stock as a sell.

Talking about the results, the company delivered a 19% increase in revenue of S$6.5 billion on a year-on-year basis. In the first nine months of 2022, it has won contracts worth S$10.3 billion, which safeguards its top-line growth in the future.

Recently, the company secured contracts in the U.S. for S$1.47 billion, which made the analysts at CGS-CIMB more optimistic. With these contracts, the company’s top line will be boosted by S$110 million for the next three to four years. The company’s order book is solid at S$25 billion as of September 2022.

ST Engineering Share Price Target

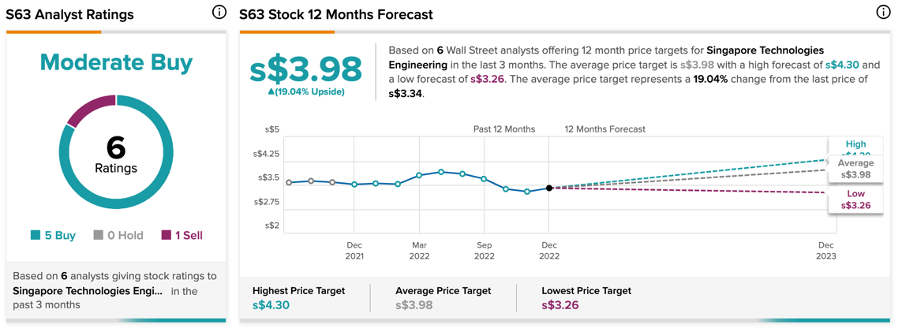

According to TipRanks’ rating consensus, ST Engineering stock has a Moderate Buy rating, based on Five Buy and one Sell recommendations.

The S63 target price is S$3.98, with an upside potential of 19.04%.

ComfortDelGro Corp. Ltd.

Based in Singapore, ComfortDelGro is a global transport company with a fleet of around 34,000 vehicles in seven countries.

This stock also enjoyed analysts’ support after its first-half results in 2022. The stock has a Buy rating from DBS, Philip Securities, RHB Capital, Maybank, CGS-CIMB, and others. The analysts remain optimistic about the company’s earnings as the business operations are back to normal levels after the easing of the lockdowns.

RHB commented, “We believe sustained strong taxi demand could spring a positive earnings surprise.”

In the first-half of the year, the group’s revenue increased by 6.7% to S$1.8 billion. It posted a 29% jump in its profit after tax of S$139 million. This included a profit from the sale of Alperton’s property in London. The company decided to pass on this gain to its shareholders in the form of a special dividend of S$.014 per share. This is the company’s first special dividend since 2007. The interim dividend for the period was S$.0285 per share.

Based on the numbers and the bullish take of the analysts, it is fair to say that the company is on the road to recovery after being severely hit by the pandemic.

ComfortDelGro Share Price Target

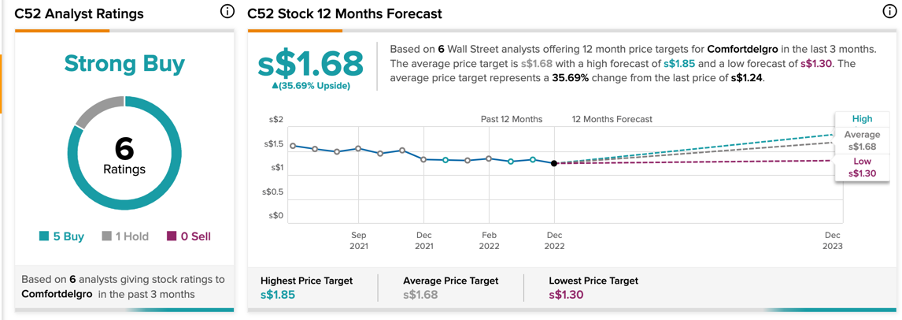

According to TipRanks, ComfortDelGro stock has a Strong Buy rating, based on five Buy, and one Hold recommendations.

The C52 price forecast is S$1.68, which has an upside of 35% on the current price level.

Conclusion

Analysts feel ST Engineering’s order book and new contracts will support its revenues in the future. The increasing costs could be a possible headwind for profits.

For ComfortDelGro, the analysts are highly bullish as air travel is back in action, pushing the company’s top-line growth.