Singapore has emerged as one of the stronger markets in 2022 as compared to its other developed counterparts. The Straits Times Index (STI), Singapore’s benchmark index, has not only remained in the green but has also increased by more than 3% this year. Less dependence on technology stocks has worked in favor of the index.

Being known as the financial hub of Asia, Singapore is well supported by its banking stocks. The banks form a major part of the STI and have contributed the most to its performance over the last few years.

Against this backdrop, we have shortlisted two SGX banking stocks from the TipRanks database that have given fairly good returns in the last year. These stocks enjoy Buy ratings from analysts, which makes them a safer bet for the future. Let’s see these banks in detail.

Oversea-Chinese Banking Corporation (SG:O39)

Oversea-Chinese Banking Corporation, or OCBC Bank, is Singapore’s oldest bank, offering banking and other financial services.

OCBC stock has remained volatile in 2022, however, and touched a few high points after the second and third-quarter results were declared in August and November, respectively. YTD, the stock has gained 13%.

Just like its other banking peers, OCBC also beat market expectations and delivered a record 31% increase in its net profit of S$1.6 billion for the third quarter of 2022. The net interest income of S$2.10 billion increased by 44% in the quarter and crossed the mark of S$2 billion for the first time in its history.

The bank remains on track to meet its full-year targets after Group CEO Helen Wong said, “I am comfortable and quite confident. We will continue to build on the momentum.”

OCBC Stock Prediction

Based on eight buy ratings, OCBC stock has a Strong Buy rating on TipRanks. The OCBC target price is S$15, representing a 22% change from the current price level.

Last month, Robert Kong from Citigroup reiterated his Buy rating on the stock with a target price of S$14.6. Kong has a success rate of 100% with an average return of 40% per transaction.

United Overseas Bank (SG:U11)

United Overseas Bank (UOB) is a Singapore-based banking institution mainly spread across Asian markets. The bank is mainly known for its strong presence in the credit card and home loan businesses in Singapore.

UOB stock got some solid action and touched the highest point in the last eight months, after the favorable third-quarter results in October 2022. Overall, the stock has been trading up by 20% so far this year.

The net profit for UOB reached a record high of S$1.4 billion, showing a growth of 34% year-on-year. The results were backed by higher interest rates and an expansion of the loan portfolio.

What is UOB Target Price?

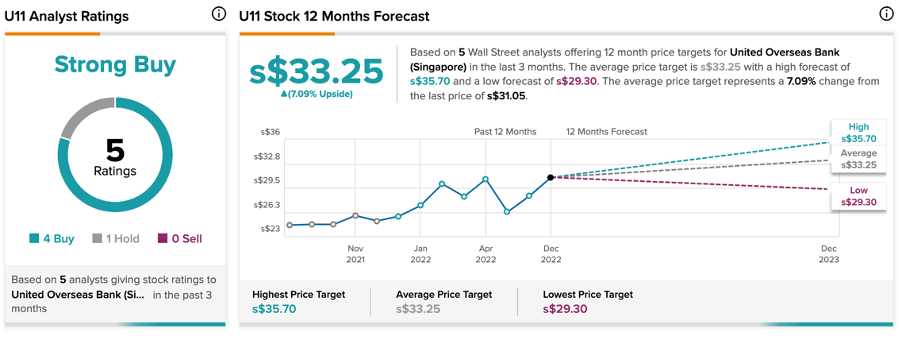

According to TipRanks analysts’ ratings, UOB stock has a target price of S$33.25, which is 7% higher than the current market price.

The stock has a Strong Buy rating based on four Buy and one Hold recommendations.

Conclusion

In the current market scenario, the banks are hanging between the benefit of higher net interest income and the risk of a slowdown in the economy from the looming recession.

The above-mentioned stocks are backed by solid fundamentals and are in a safe place to grow in a higher-rate environment. These stocks could be a great addition for investors looking to build a balanced portfolio.