Spanish companies Telefonica SA (ES:TEF) and Iberdrola SA (ES:IBE) will announce their second-quarter earnings for 2023 next week on July 27. In terms of share price appreciation, both of these stocks have limited upside potential and have been rated as Hold by analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The TipRanks Earnings Calendar tool is now available in nine different markets and provides accurate and timely information on upcoming earnings. Using this tool, users can access systematic and up-to-date data about companies’ earnings.

Let’s take a look at the details.

Telefonica SA

Telefonica is a prominent telecommunications company based in Spain, offering a wide range of services such as voice, data, television, and Internet access to both individual consumers and businesses.

TheSpanish telecom company is set to announce its second-quarter earnings for 2023 on July 27. According to TipRanks, analysts anticipate a consensus EPS forecast of €0.09 per share, showing an improvement from the EPS of €0.05 reported in the same quarter of the previous year. The projected sales for the next quarter are €10.03 billion.

Despite challenging economic conditions in 2022, the company achieved a stable performance. In 2023, it plans to increase investments in connectivity projects. The company anticipates revenue growth at a “low single-digit rate” in 2023, aligning with the 4% growth recorded in 2022. The company’s core earnings are also expected to maintain a level similar to the previous year.

Are Telefonica Shares a Good Buy?

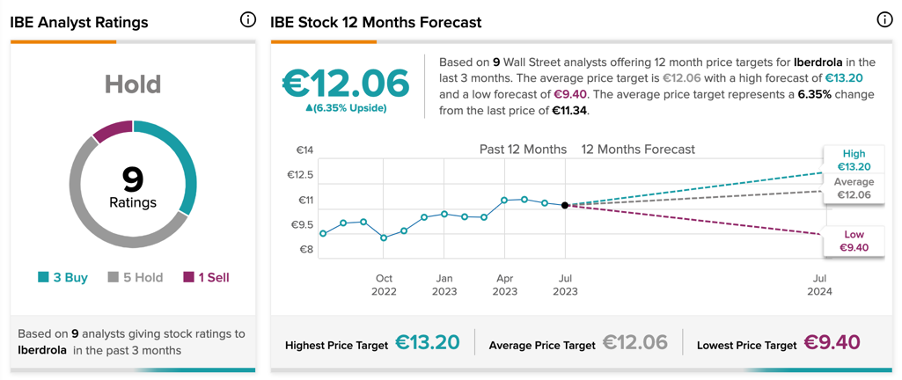

On TipRanks, TEF stock has a Hold rating backed by a total of five recommendations, including one Buy, three Hold, and one Sell recommendations.

At an average price target of €3.90, analysts predict an upside of 5.6% on the share price.

Iberdrola SA

Iberdrola is a leading Spanish utility company specializing in clean and renewable energy solutions.

The company will also publish its Q2 2023 earnings report on July 27. The consensus EPS forecast for the quarter is €0.16 per share, similar to the previous year’s EPS during the same quarter. According to analysts, the expected sales for the quarter are €11.95 billion. After reporting higher earnings in its first quarter, Iberdrola anticipates mid-to-high single-digit growth in full-year net profit. The company is also aiming to increase organic investments to €12 billion in 2023.

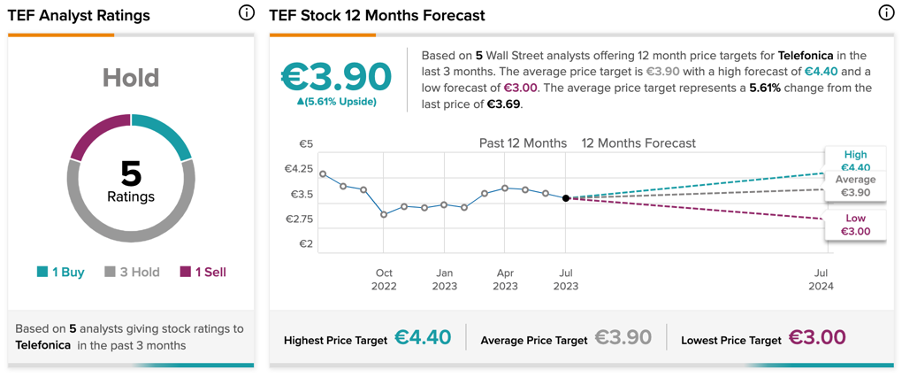

Ahead of the second quarter numbers, J.P. Morgan analyst Javier Garrido confirmed his Hold rating on the stock, forecasting a growth of 5.8% in the share price.

Two days ago, Alberto Gandolfi from Goldman Sachs also reiterated his Hold rating, predicting a little higher upside of 16.4%.

Is Iberdrola Stock a Buy?

The stock has gained good momentum in the last year, with a growth of 20%. As a result, analysts are forecasting limited growth in the share price for the next year.

Overall, IBE stock has a Hold rating on TipRanks based on three Buy, five Hold, and one Sell recommendations. The average price forecast is €12.06, which is around 6.3% higher than the current trading levels.