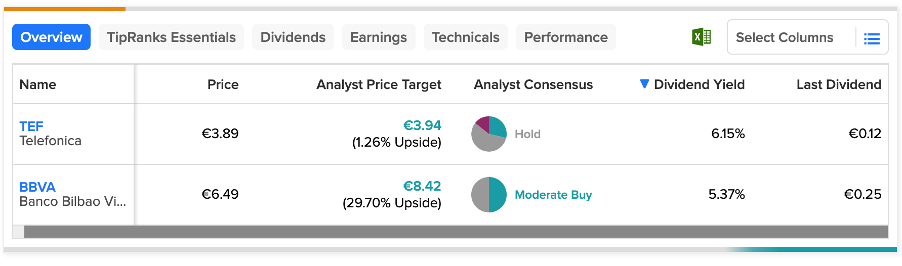

Spanish companies Banco Bilbao Vizcaya Argentaria (ES:BBVA) and Telefonica (ES:TEF) are currently offering more than a 5% dividend yield to investors. Furthermore, these stocks rank among the top 10 companies in Spain in terms of their highest dividend payouts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Telefonica does not offer substantial opportunities for capital growth, earning a Hold rating from analysts. BBVA, on the other hand, demonstrates a growth potential of nearly 30% along with a Moderate Buy rating.

Here, we have used TipRanks Top Spain Dividend Stocks to select these companies. With this tool, users can choose from the top dividend-paying companies in a specific market and make comparisons based on key factors such as analyst recommendations, price targets, dividend yield, and other pertinent metrics.

Let’s take a look at some details.

Banco Bilbao Vizcaya Argentaria SA

BBVA is a leading Spanish financial institution, providing retail banking, private banking, asset management, and other related solutions.

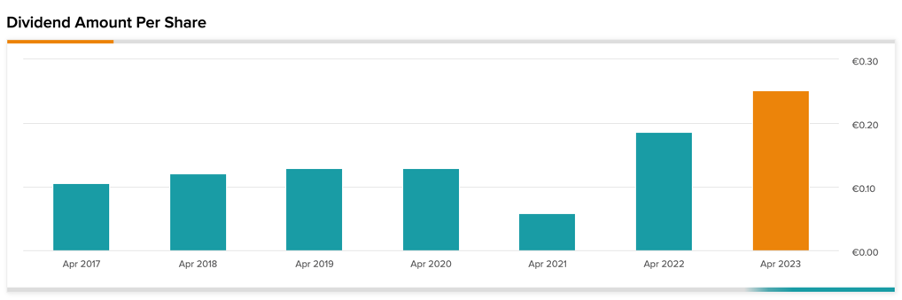

The company allocated more than €3 billion in 2022 for shareholder returns through dividends and a newly introduced share buyback program. The company has a dividend yield of 5.37%, surpassing the industry average of 2.11%. The final dividend of €0.31 per share for 2022 was paid in April 2023. This makes the total dividend of €0.43 per share for 2022, which was 39% above the payments in 2021 and also the company’s highest in the last 14 years.

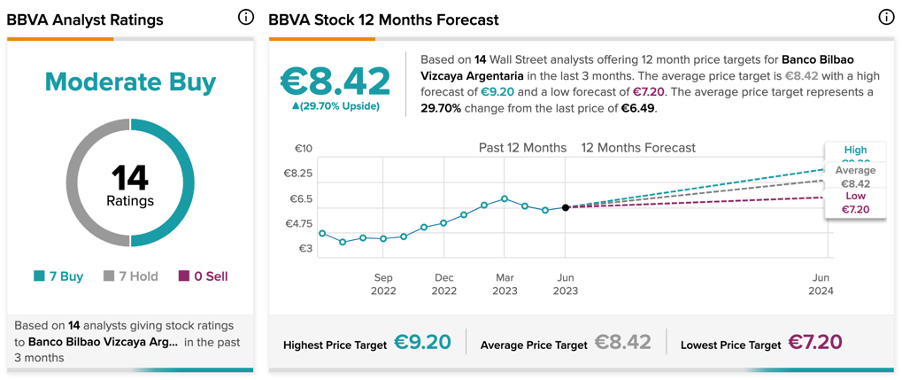

BBVA Share Price Forecast

According to TipRanks, BBVA stock has a Moderate Buy with a total of 14 recommendations from analysts. It includes seven Buy and seven Hold ratings.

The average price target is €8.42, which is 30% higher than the current price level.

Telefonica S.A.

Based in Spain, Telefonica is a global telecommunications company, offering fixed-line, mobile, and broadband services.

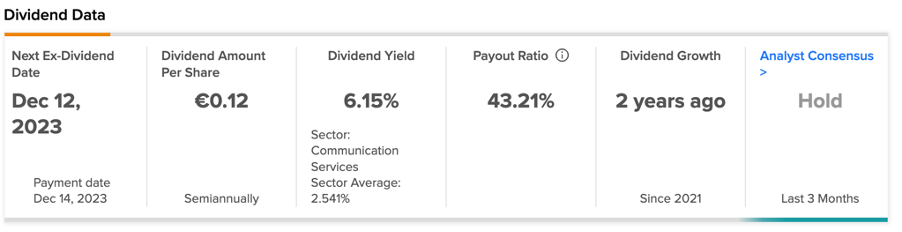

The company carries a dividend yield of 6.15%, making it a good fit for income investors. For 2022, the company announced a gross dividend of €0.30 per share, paid in two equal parts.

The company started the year 2023 on a strong note, as evidenced in its first-quarter earnings. It registered growth in all the major markets which pushed its total revenues by 6.7% to €10 billion during the quarter. The company’s Q1 results indicate progress towards achieving its financial targets for the entire year, positioning it to proceed with the distribution of the 2023 dividend of €0.30 per share. The dividend will be paid in two installments, with the first payment due in December 2023 followed by the other in June 2024.

Telefonica Share Price Prediction

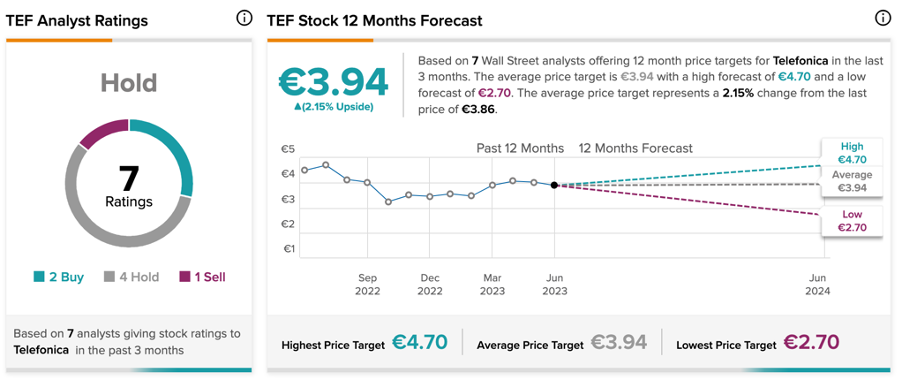

TEF stock has a Hold rating based on two Buy, four Hold, and one Sell recommendations. At an average price forecast of €3.94, the upside potential is limited with a change of just 2.15% from the current level.

Conclusion

For investors looking to boost their passive income, these stocks could be worth considering as potential additions to their portfolios. Among them, BBVA has received a Moderate Buy rating from analysts, projecting a growth potential of 30%. On the other hand, TEF has a Hold rating and a modest 2% growth potential in its share price.