European chipmaker STMicroelectronics N.V. (FR:STMPA) (IT:STMMI) forecasted lower Q1 sales, indicating a more than 15% decline following a lacklustre performance in the fourth quarter for FY23. The downfall was mainly attributed to reduced orders from the industrial sector and a slowdown in demand for personal electronics. The Q1 FY24 performance was also hit by trade disputes between the U.S. and China.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Investors reacted negatively to the results, with the Paris-listed shares of STMicroelectronics trading down by 2.24% as of writing. Similarly, the shares listed on Borsa Italiana declined by 1.4%.

STMicroelectronics is a global technology company specializing in the design of semiconductors and serving a diverse range of sectors, including industrial, automotive, and data centers.

Q4 Performance

In the fourth quarter of FY23, net revenues were down 3.2% on a year-over-year basis to $4.28 billion, falling slightly below analysts’ average estimate of $4.3 billion. During the quarter, the company observed a sequential decline in customer order bookings. While demand in the automotive sector was stable, there was no notable upswing in personal electronics. Simultaneously, the industrial segment experienced a decline.

For the full year 2023, revenues grew 7.2% to $17.29 billion.

Weak Outlook

Moving ahead, STMicroelectronics expects to post a net revenue of $3.6 billion for the first quarter of FY24, reflecting a year-over-year decrease of 15.2% and a sequential decrease of 15.9%. Moreover, the company is targeting annual revenue in the range of $15.9 billion to $16.9 billion. It intends to allocate approximately $2.5 billion to net capital expenditures in FY24.

Following the update, analyst Alexander Duval from Goldman Sachs reiterated a Sell rating on STMicroelectronics stock. He stated that the sales guidance for FY24, at the midpoint, is 6% lower than the consensus compiled by his firm.

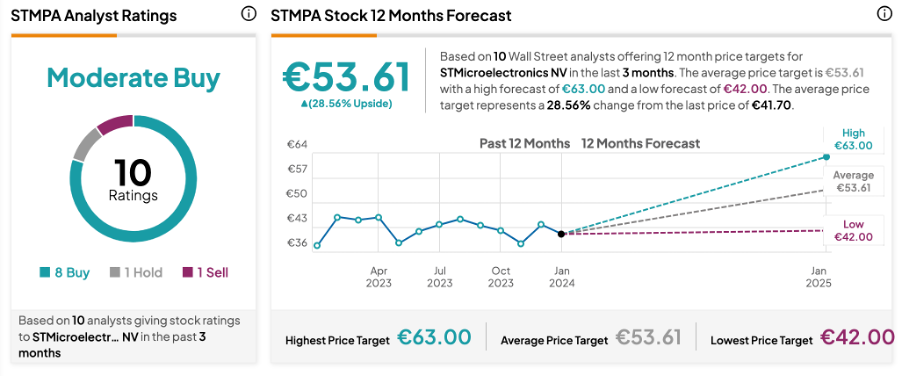

What is the Target Price for STMicroelectronics?

On TipRanks, STMPA stock has received a Moderate Buy consensus rating based on eight Buys, one Hold, and one sell recommendation. The STMicroelectronics share price target is €53.61, which is 28.6% above the current trading price.