Analyst ratings are one thing to keep an eye out for when deciding which stock to invest in. Not only is it important to buy the stock at the right time, but it is equally important to sell the stock at the right time.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Analyst ratings are based on thorough research and investigation of the company. TipRanks offers you numerous analysts whose ratings can guide investors to earn returns and minimize losses. The ratings consider all the pros and cons of different aspects, which are not readily available to investors.

Let’s take a look at two Spanish stocks and the analysts’ opinions on them.

INDUSTRIA DE DISENO TEXTIL S.A (ES:ITX)

Industria de Diseno Textil SA (Inditex) is a global fashion company that owns well-known brands such as Zara, Pull & Bear, Massimo Dutti, Oysho, and more.

Inditex’s share prices fell sharply in March 2022, after it closed all its operations in Russia following its attack on Ukraine. Later on, the company even sold its Russian business to Daher Group. Overall, the stock is trading down 11% YTD.

Today, the company reported its third-quarter earnings, with an 11% jump in its sales to €8.2 billion. This was mainly pushed by the rise in in-store customers, which has significantly increased after the removal of lockdowns. Increasing the prices across some categories also helped the company achieve this growth. However, the cost increased by 13% during the quarter due to current inflationary pressures in the economy. The company remains committed to cost control with stricter measures. The net profit was up by 6% to €1.3 billion.

The company also took an additional hit of €14 million as exit charges after the sale of its Russian business.

Inditex Stock: Buy or Sell?

The analysts are highly impressed with the company’s recent quarterly results. James Grzinic from Jefferies commented on the results as ‘upbeat’. Grzinic has a Buy rating on the stock.

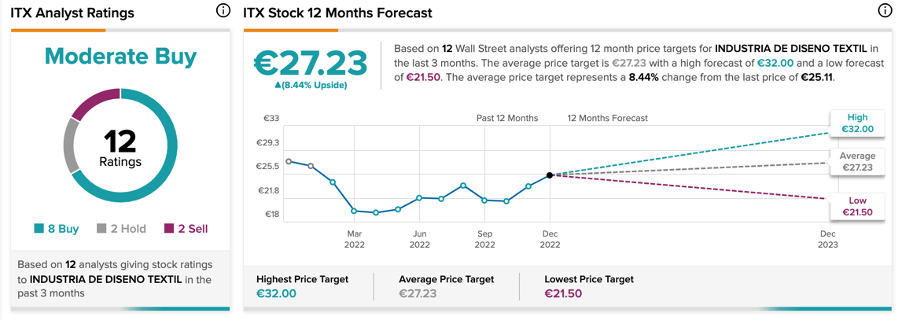

According to TipRanks’ rating consensus, Inditex stock has a Moderate Buy rating with eight Buy recommendations.

The average target price for ITX is €27.23, which shows an 8.4% increase on the current price level.

Naturgy Energy Group SA (ES:NTGY)

Based in Spain, Naturgy is an energy company operating in the electricity and gas markets.

Naturgy’s stock has generated a 36% return for its shareholders in the last three years and a 77% return in the last five years. The stock has been a gem for long-term investors.

The company is facing concerns over the continued volatility in energy prices and the regulatory pressures associated with them. Nonetheless, the company reported better-than-expected numbers for the first nine months of 2022. The company’s net profit increased from €777 million for the same period in 2021 to €1.06 billion this year.

Naturgy also announced an interim dividend of €0.40 per share for the second time in 2022.

Naturgy Stock Price Forecast

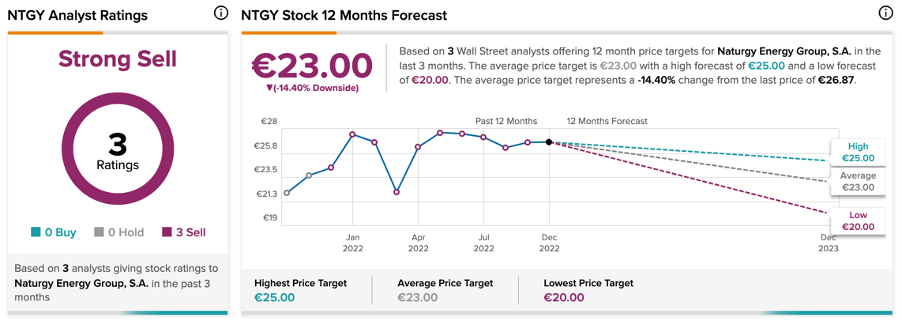

According to TipRanks, Naturgy stock has a Strong Sell rating, based on three sell recommendations.

The NTGY average target price is €23, which is 14.4% lower than the current price level. The target price has a high forecast of €25 and a low forecast of €20.

Recently, J.P. Morgan analyst Javier Garrido raised his target price on the stock from €21.8 to €25 while maintaining his Sell rating.

Ending Thoughts

Most investors are still learning the various parameters involved in analyzing and picking the right stock. In such situations, it is always better to trust the analyst’s ratings and make informed decisions.

Analysts are highly bullish on Inditex stock and expect better numbers in the full-year results of 2022. On the other hand, analysts have a Sell rating on Naturgy stock.