In an unexpected turn of events, the FTSE 100-listed oil and gas company Shell PLC (GB:SHEL) is grappling with an unplanned outage at its Pernis refinery, which also happens to be Europe’s largest oil refinery. This disruption, which is due to a gas leak, has sent ripples through the energy market, raising concerns about the supply and pricing of petroleum products in the region.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Although the refinery will remain in operation, the suspension of the Hycon plant, as it is commonly referred to, will lead to complications in the production of refined fuels.

In response to the news, Shell’s share price declined yesterday and has extended its losses today, currently showing a decrease of 0.31% at the time of writing.

Headquartered in London, Shell is a leading energy company engaged in the production of oil and natural gas. The company has operations in around 70 countries worldwide.

The Unforeseen Setback

The Pernis refinery, situated in the Netherlands, is a crucial hub for Shell’s European operations, with a refining capacity of about 404,000 barrels of crude oil per day. The refinery is involved in the production of an extensive array of products, encompassing various fuels and raw materials utilized in chemical plants.

The European diesel market has been facing supply constraints since the loss of a significant external supplier following sanctions imposed on Russia. Additionally, a particularly warm summer has hindered production, resulting in lower inventories in the region. The sudden disruption has further raised concerns about the supply of refined petroleum products in Europe.

Dealing with unplanned outages is not uncommon in the oil and gas industry, given the complexity of refinery operations. Shell is no stranger to managing such challenges and has a robust track record of addressing disruptions swiftly. The company remains dedicated to maintaining a safe and reliable supply of energy products to meet the needs of its customers.

Is Shell a Good Stock to Buy?

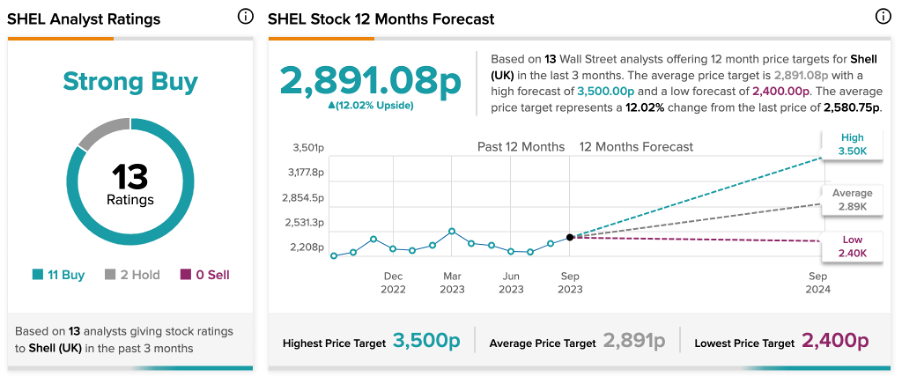

As per the consensus among analysts on TipRanks, SHEL stock has been assigned a Strong Buy rating. The company’s ratings consist of 11 Buy and 2 Hold recommendations.

The Shell share price target is 2,891.08p, with a high and a low forecast of 3,500p and 2,400p, respectively. This price target indicates a potential change of 12% from the current share price.