The SGX-listed United Overseas Bank Ltd. (SG:U11) offers an attractive income opportunity, with a dividend yield of 5.81% that exceeds the industry average. UOB is well-known among investors for its consistent dividend income and ranks among Singapore’s top dividend payers. Additionally, the bank’s earnings growth adds further credibility to its dividend story.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In terms of share price appreciation, analysts have rated the stock a Moderate Buy and predict around 15% growth in the share price.

Here, we used the TipRanks’ Top Singapore Dividend Stocks tool to pick UOB stock. This tool is useful for screening stocks from a particular market and analyzing them across various parameters. It is available across 10 different markets on TipRanks.

UOB holds a prominent position as one of the top three banks in Singapore. The bank boasts a global network that spans 500 branches in 19 countries in the Asia Pacific, Europe, and North America.

Let’s take a look at the details.

Dividends Backed by Solid Numbers

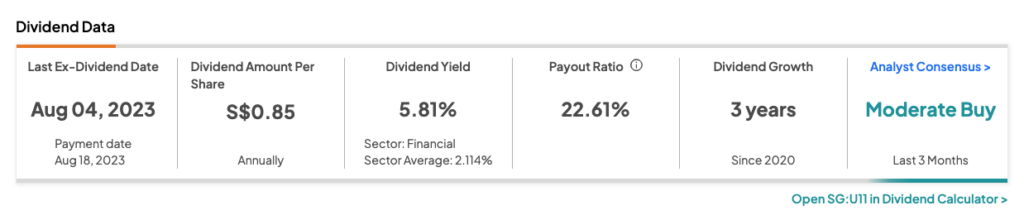

In August 2023, the bank paid an interim dividend of S$0.85 per share, surpassing the S$0.60 paid during the same period in 2022.

In 2023, UOB made a significant move by acquiring Citigroup’s consumer business in Malaysia, Thailand, Indonesia, and Vietnam for about S$5 billion. This strategic acquisition effectively doubled UOB’s retail customer base to over 7 million, positioning it as one of the top stocks to monitor in the foreseeable future. The integration of this acquisition remains on track, and the bank expects to achieve an annualized revenue growth of nearly S$1 billion for the year 2023.

UOB delivered decent numbers in its Q3 results for FY23, supported by higher interest rates. In its third quarter, the net interest income increased 9% year-on-year, reaching S$2.4 billion. The net interest margin (NIM) rose to 2.09%, marking a 14 basis point improvement from the previous year. The core net profit grew by 5% to S$1.5 billion.

In terms of outlook, UOB anticipates low-to-mid-single-digit year-on-year loan growth for the full year. Moreover, the net interest margins are expected to remain high. The fee income is projected to grow by high-single-digits year-on-year.

What is the Target Price for UOB?

Year-to-date, the UOB share price has been trading down by 11.24%.

U11 stock has received a Moderate Buy rating on TipRanks, backed by four Buy and three Hold recommendations. The average target price is S$31.47, which indicates an upside of 15.24% from the current level.