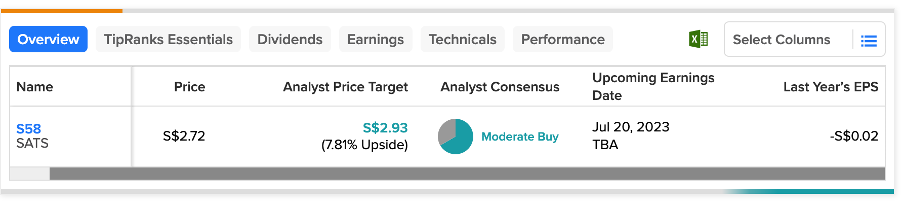

SGX-listed SATS Limited (SG:S58) will release its first-quarter earnings for fiscal year 2024 this week on July 20. Ahead of the earnings, analysts have rated the stock as a Moderate Buy with limited upside potential in the share price.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

SATS is predominantly a food services company with a specialization in catering for the aviation sector. Furthermore, the company provides additional services such as aviation security, warehousing, and passenger services.

Analysts’ Opinion

With the global recovery in air travel, the company is witnessing huge improvements in air cargo volumes. The travel segment continues to be the primary source of revenue for the group.

The company’s revenues from Greater China are expected to further increase due to the significant contribution of flights between China and Singapore, driven by the reopening of borders. Analysts also believe the decline in the share price presents an attractive opportunity for investors. The shares have traded down by almost 30% in the last year.

For the full year 2023, the company posted a 49% jump in its revenues to S$1.76 billion. The revenues exceeded analysts’ expectations and are expected to grow in a similar manner for the next two years. In 2023, the company also posted a loss of S$26.5 million due to its one-time expense for the acquisition of Worldwide Flight Services (WFS). Analysts are bullish on this acquisition, which will assist the company in establishing geographic and business resilience as it steps into its next phase of growth.

26 days ago, Neel Sinha from CLSA reiterated his Buy rating on the stock, predicting an upside of 14% in the share price.

What is the Forecast for SGX S58?

TipRanks rates S58 stock as a Moderate Buy, with four Buy and two Hold recommendations. The average target price is S$2.93, which is 7.8% above the current trading level. The price target ranges from a low forecast of S$2.51 to a high forecast of S$3.20.