SAP SE (DE:SAP) holds a dominant position in the enterprise solutions industry. The company’s stock has experienced a notable increase of nearly 30% YTD in 2023. Analysts continue to express optimism for the stock and have assigned it a Strong Buy rating. In terms of share price growth, analysts expect a modest increase of 10% in a 12-month forecast period.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s examine some of the reasons why investors should contemplate adding this stock to their portfolio.

The Tailwinds

The company recently completed its deal to sell its stake in software company Qualtrics to Silver Lake Management and CPP Investments for $7.7 billion. Analysts view the deal positively, anticipating that it will transform the company into a net cash-positive entity.

The company’s Q1 2023 earnings exhibited commendable financial performance, with its revenue surpassing expectations. The company’s cloud business, which has garnered significant attention from investors, experienced a notable 24% increase in sales. The business is experiencing improved revenue visibility, as evidenced by a 25% increase in its cloud backlog of €11.1 billion.

The management is confident in the momentum of its cloud business and maintains its outlook for ongoing operations, which includes an expected acceleration of growth in both topline revenue and operating profit.

“Perfect 10” Smart Score

SAP stock has earned a spot on the “Perfect 10” Smart Score list, signifying its strong potential for outperforming the market. The stock has been on this list for the last 20 days. The Smart Score is a data-driven rating system that incorporates six distinct data sets, including analyst recommendations, media sentiment, and various technical stock factors. The tool assigns a score from one to ten to stocks, offering insights into their potential to outperform overall market returns.

SAP Share Price Forecast

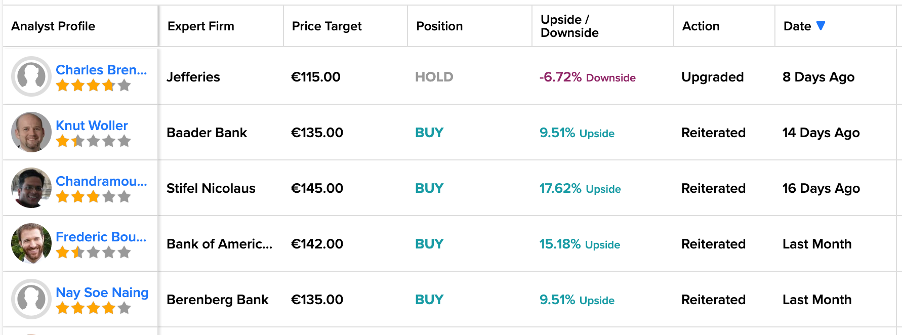

SAP enjoys wide coverage from analysts, who are mainly bullish on its stock. Over the last month, many analysts have reiterated their Buy ratings on the stock.

According to TipRanks’ rating consensus, SAP stock has a Strong Buy rating. The projected average price for the stock is €135.56, indicating an upside of 10% on the share price.

The Bottom Line

SAP’s transition towards cloud business is expected to increase the proportion of recurring sales in the company’s revenue mix. Moreover, the positive outcome of its Q1 results lays a strong foundation for its full-year projections of achieving profitable growth in 2023.

Presently, analysts have assigned a Strong Buy rating to the stock.