German companies PUMA SE NPV (DE:PUM) and Deutsche Pfandbriefbank (DE:PBB) have a forecasted upside potential of more than 45% in their share prices. According to analysts, both stocks have moderate Buy ratings.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s take a look at some details.

PUMA SE

PUMA is a renowned German brand with global recognition, specializing in the design and retail of sportswear clothing and footwear.

Over the past three years, the company’s stock has faced challenges, resulting in a decline of 31%. YTD, the stock has continued to trade downward, experiencing a decrease of 16%. Macroeconomic headwinds, higher inventory levels, and stretched margins continue to put pressure on the company’s outlook and its share price.

However, analysts remain bullish on the company’s long-term prospects, considering its solid brand position, global diversification, and positive developments in China. After a period of more than two years of declining business, PUMA has successfully regained growth in the Greater China region.

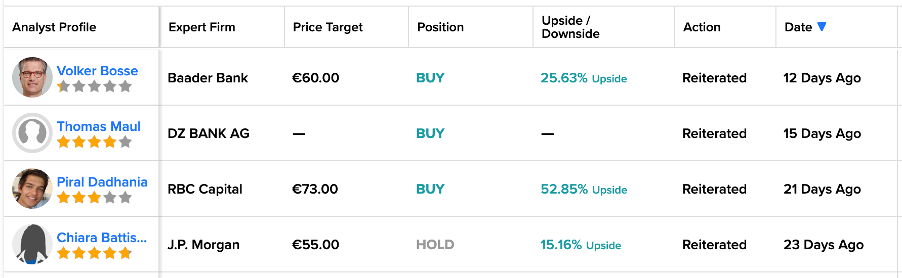

Over the last few months, four analysts have shown further confidence in the stock, reiterating their ratings. Among these, Piral Dadhania from RBC Capital has the highest price target of €73, which is 52% higher than the current price level.

Most recently, 12 days ago, Baader Bank’s analyst Volker Bosse also reiterated his Buy rating on the stock, predicting an upside of 25%.

Is Puma a Good Stock to Invest in?

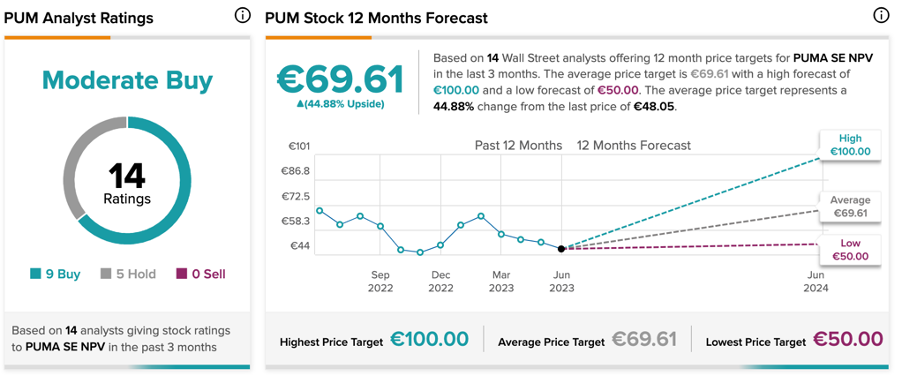

According to TipRanks, PUM stock has a Moderate Buy rating with nine Buy and five Hold recommendations.

The average price forecast is €69.61, which represents a 45% change from the current price level.

Deutsche Pfandbriefbank AG

Deutsche Pfandbriefbank is a German bank focused on real estate and public investment finance.

Over the past year, the company’s stock has experienced a downward trend, with a total decline of 24.3%. In the last three months, the stock has dropped by almost 20%. The stock suffered another hit after the company reported its Q1 2023 earnings in May. The company posted lower numbers than the previous year but did surpass analysts’ expectations.

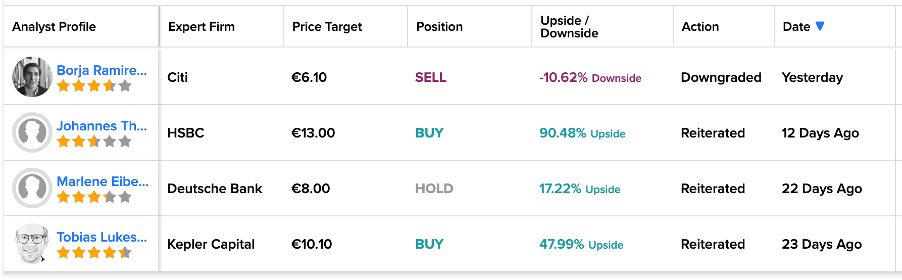

Analysts have mixed opinions on the stock on TipRanks. Yesterday, Citigroup’s analyst Borja Ramirez Segura downgraded his rating from Hold to Sell on the stock. He reduced his price target from €8.6 to €6.10, predicting a downside of 10.6% in the share price. Segura believes that the commercial real estate market is experiencing a downturn, with a decline in investor demand and a decrease in prices.

On the other hand, analyst Johannes Thormann from HSBC reiterated his Buy rating on the stock 12 days ago. Thormann is highly bullish on the stock and anticipates a 90% growth in the share price.

Deutsche Pfandbriefbank Stock Forecast

On TipRanks, PBB stock has a Moderate Buy rating with a total of four recommendations. It includes two Buy and two Hold ratings.

The average stock forecast is €9.93, which has an upside potential of 45%. The target price has a high forecast of €13 and a low forecast of €8.

Conclusion

While making investments in the German market, investors could consider these stocks as offering higher upside growth.