British pet supplies company Pets at Home Group Plc (GB:PETS) disappointed investors as it trimmed its FY24 profit guidance in its Q3 trading update. The company now expects full-year profit before tax (PBT) of £132 million, down from the previous estimate of £136. The company cited lower-than-anticipated growth in its retail division as the reason for the guidance cut.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Shares fell 6% earlier in the day but pared the losses to close modestly higher at 293.40p, as investors chose to focus on the positive aspects of the Q3 update. Overall, the Pets at Home share price has declined more than 17% in the past year.

Pets at Home Group Plc is the U.K.’s leading pet care business and offers pet products and services across more than 450 centres and online.

Pets at Home’s Q3 FY24 Update

Pets at Home’s Q3 FY24 revenue rose 4.3% year-over-year to £362.4 million, driven by an impressive 13.4% growth in its Vet Group business. The Vet business benefitted from the recruitment of more professionals and an increase in average spending. The company noted that its Retail revenue increased 3.5% but lagged expectations, mainly due to the soft trends in discretionary accessories.

Looking ahead, Pets at Home believes that innovation will be vital to ensure growth in its accessories business. It also expects to benefit from the launch of its new distribution centre and digital platform. Management assured that the business remains well-positioned to gain from long-term growth prospects in the pet sector.

Following the update, Hargreaves Lansdown analyst Sophie Lund-Yates said that Pets at Home’s sales performance has fallen “far out of line.” She added that investors would be displeased with the lowered profit guidance, as they have been looking at the company as a resilient option in a tough consumer backdrop.

The analyst contended that while the company’s food sales continue to be stronger than its accessories business, they have lost some momentum. She added that pet owners are refraining from buying extra products due to a challenging macro environment.

What is the Share Price Target for Pets at Home?

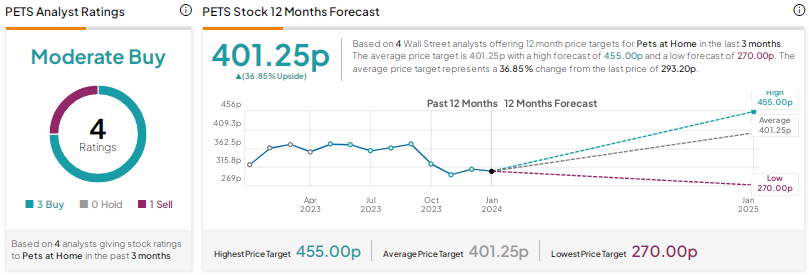

Analysts’ Moderate Buy consensus rating on PETS stock is based on three Buys and one Sell. The Pets at Home share price target of 401.25p implies nearly 37% upside potential.