UK-based companies National Grid (GB:NG) and Legal and General (GB:LGEN) present an attractive dividend story for investors. These renowned market players have established a reputation for delivering consistent dividends throughout the years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

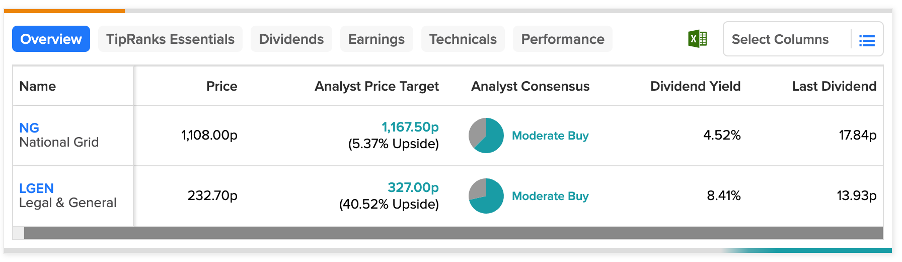

Investing in dividend stocks not only guarantees an extra income stream but also offers the opportunity for long-term growth in capital value. Analysts suggest that these companies also exhibit promising growth in their share prices and have rated them as Moderate Buy. Among these companies, LGEN demonstrates a higher growth potential of 40%, whereas NG shows the potential for a 5% increase in share price.

Let’s take a look at these companies in detail.

National Grid PLC

National Grid is a British utility company engaged in the electricity transmission and distribution sector.

Yesterday, the company announced its 2023 earnings, where it posted higher profits and restated its financial projections until the end of FY 2026. The company posted an underlying operating profit of £4.6 billion for the year, which was 15% higher as compared to the previous year. The profits were mainly driven by the UK electricity distribution business, slightly offset by higher interest costs.

The company proposed a final dividend of 37.6p per share, resulting in a total dividend of 55.44p for 2022. The dividend reflected a growth of 8.8% from last year’s payments. Currently, the shares provide a dividend yield of 4.47%.

National Grid is well-placed to assume a significant role in the energy transition in the UK. This will drive further growth for the company by supporting its dividend policy.

What is the Future of National Grid Stock?

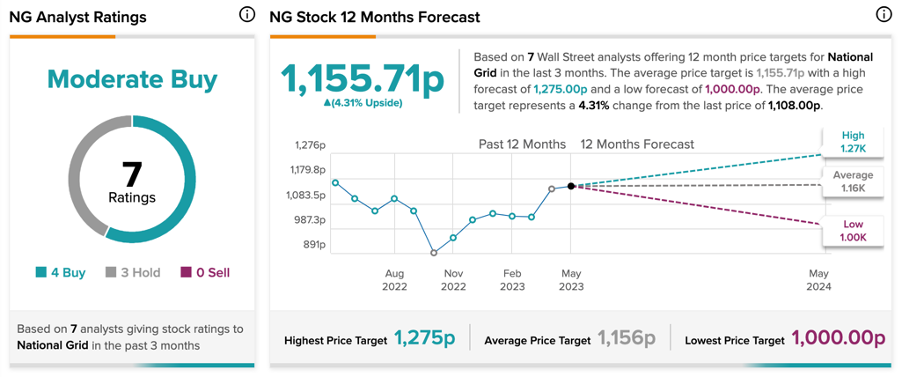

According to TipRanks, NG stock has a Moderate Buy rating based on four Buy and three Hold recommendations.

The average target price is 1,155.7p, which is 4.3% higher than the current price level.

Legal & General Group PLC

Legal & General is a prominent UK-based financial institution that specializes in offering a wide range of services, including insurance, pensions, retirement plans, and asset management.

The company’s stock provides an appealing dividend yield of 8.43%, surpassing the industry average of 2.1%. The company’s total dividend for 2022 grew by 5% to 19.37p per share. In 2022, the group witnessed a 12% increase in net profit and earnings per share, enabling the company to boost its dividend payout.

The management has made a firm commitment to maintaining a progressive dividend policy, with a projected annual growth of 5% in dividends per share until 2024.

Is Legal and General Stock a Buy?

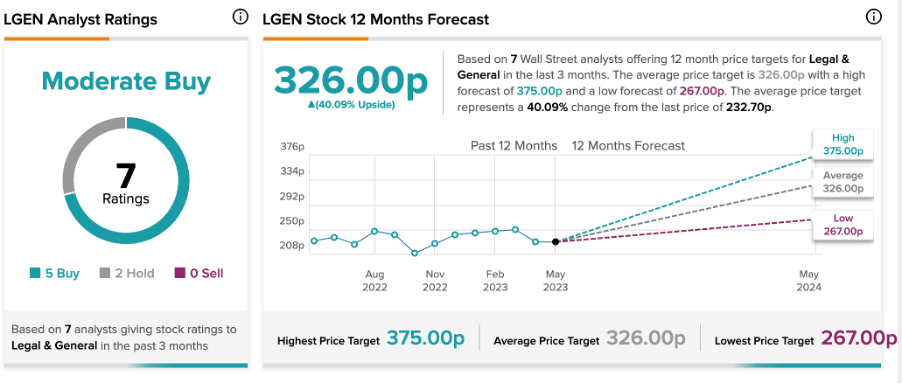

LGEN stock has been assigned a Moderate Buy rating on TipRanks, as indicated by five Buy and two Hold recommendations.

The average target price of 326p suggests a huge upside of 40% in the share price.

Conclusion

National Grid and Legal & General have established commendable track records of growth, which have bolstered their ability to maintain stable dividend payments. These UK stocks offer reliable options for investors seeking dividends supported by steady earnings.