Australian banks ANZ Group Holdings (AU:ANZ) and National Australia Bank (AU:NAB) will announce their first-half results for 2023 this week.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

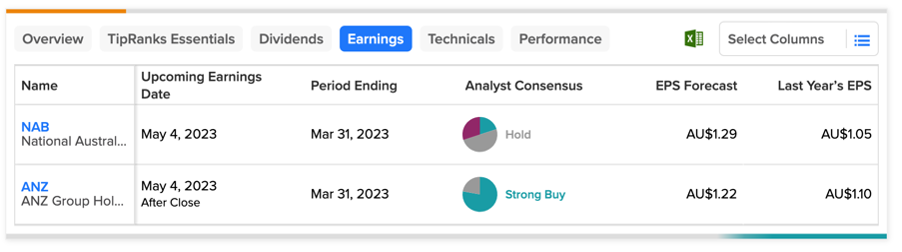

As bank stocks hold a significant share of the Australian share market, these big banks in the country usually receive extensive scrutiny during every earnings season. Prior to their upcoming results, analysts have assigned a Hold rating to NAB, while ANZ has been rated as Strong Buy.

Analysts expect that the earnings indicators for NAB and ANZ will stay fairly steady over the next two years, despite some potential pressures in 2024. The net interest rate margins are also expected to reach their peak point in this financial year before they start falling next year.

Here, we have used the TipRanks Earnings Calendar for the Australian market to identify these companies. This tool is now available in seven different markets and offers clear and regularly updated information on upcoming company earnings.

Let’s have a closer look at them.

National Australia Bank Limited

With over eight and a half million customers, NAB is among the four largest banks in Australia. The bank will announce its half-yearly earnings for 2023 on May 4. NAB started FY23 with robust numbers, and its strategy is effectively fueling focused growth throughout its business.

According to TipRanks, the consensus EPS forecast is AU$1.29 per share for the second quarter, as compared to the EPS of AU$1.05 reported in the same period of the previous year. The bank is expected to announce cash profits of AU$4.2 billion.

In terms of dividends, Goldman Sachs has forecast the annual dividends for 2023 to be AU$1.68 per share, up from AU$1.51 in 2022. The broker has a Buy rating on the stock and expects an upside of 22% on the current share price. Analyst Andrew Lyons from Goldman Sachs is bullish on the bank’s exposure to commercial lending and predicts more favorable volumes as compared to housing loans.

What is the Future of NAB Share Price?

TipRanks’ rating consensus indicates that NAB stock has a Hold rating, with two Buy, five Hold, and three Sell recommendations.

The average target price is AU$29.18, which is almost similar to the current trading price.

Australia and New Zealand Banking Group Limited (ANZ)

Operating in around 30 markets, Australia and New Zealand Banking Group Limited is also part of the top four largest banks in Australia.

The bank will announce its half-yearly results by the end of this week, on May 5. Analysts predict an EPS of AU$1.22 per share for Q2 2023, higher than last year’s figure of AU$1.1 per share in the same quarter. ANZ is expected to post cash earnings of AU$3.8 billion for the six months.

The broker, Goldman Sachs, has slightly higher cash earnings expectations of AU$3.9 billion as compared to the market consensus. The profits will be driven mainly by a significant expansion in net interest margins.

As far as dividends are concerned, Goldman is expecting an 11.1% jump in the bank’s interim dividends to AU$0.80 per share.

ANZ Share Price Target

The current average target price for ANZ stock is AU$26.62, which is approximately 8.3% higher than the current trading price.

On TipRanks, the stock has a Strong Buy rating, supported by seven Buy and two Hold recommendations.

Conclusion

As a result of ten back-to-back interest rate hikes since May 2022, which is considered one of the most aggressive tightening cycles in Australia, the big banks have experienced their strongest revenue and profit growth in decades.

However, experts feel that these banks will face a tougher time during the second half of 2023, as they have been compelled to raise interest rates on savings deposits. The bad debts could also increase as people face difficulties paying their mortgages due to rising interest rates and the ongoing cost of living crisis.