UK-based Marks and Spencer PLC’s (GB:MKS) shares soared over 7% yesterday after the company raised its profit outlook for the fiscal year 2023-24. With a growing presence in sectors such as clothing, groceries, and home products, the company expects an uptick in sales for its upcoming half-year results. Further, the company anticipates substantial profit growth across its operations for the full year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company’s shares gained 7.4% on Tuesday, making their way to the top of the FTSE 250 index charts.

Marks and Spencer is a prominent British retailer that caters to a wide range of customers. The company is known for its extensive selection of clothing, food, and home goods.

The Update

During the first 19 weeks that ended on August 12, 2023, the company reported that its food sales grew by 11%, driven by improved quality and price hikes in its product lines. Its clothing and home sales were up 6%, with higher footfall in stores and improved customer spending. Overall, the group’s operational margin also remains resilient, supported by vigorous store performance and the ongoing store rotation and renewal initiative.

Based on this growth, the company now expects to post profit growth over its 2022–23 numbers. This represents an improvement over the earlier projections of a decline in full-year profits. and signifies advancement in M&S’s turnaround strategy to restructure its business.

The company will announce its half-yearly earnings in November 2023.

Re-entering the FTSE 100 Index

The stock has been trading up by more than 70% so far in 2023, establishing itself as among the leading performers within the FTSE 250 index. This holds genuine significance for investors. With this level of market capitalization, the company’s shares are eligible again to be part of the FTSE 100 index. If the company successfully rejoins the FTSE 100 index, the index funds will be naturally interested in its stock, which would result in a potential surge in the share price.

The anticipated switch, which is set to occur next month in September, is eagerly awaited by analysts and investors.

What is Marks and Spencer’s Stock Price Prediction?

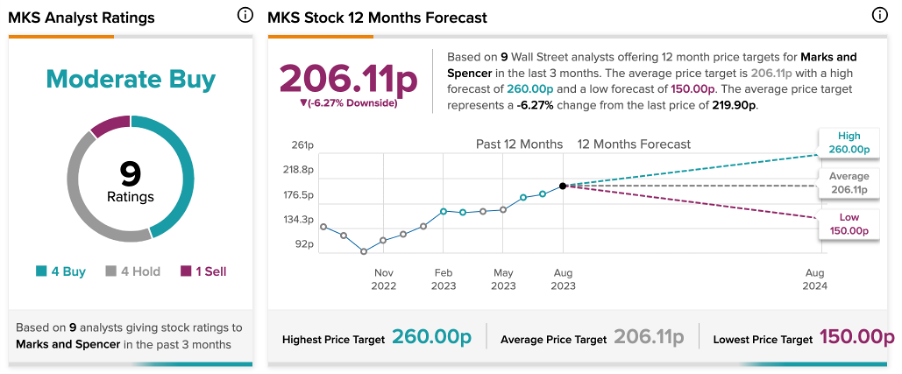

The stock price prediction for the 12-month period is 206.1p, which is 6.27% below the current trading levels. On TipRanks, MKS stock has received a Moderate Buy consensus among analysts, comprising four Buy, four Hold, and one Sell recommendations.

It’s crucial to highlight that these ratings were assigned prior to this update, and analysts are anticipated to make certain positive adjustments in response.