The UK-based Compass Group PLC (GB:CPG) has agreed to acquire its regional rival contract caterer, CH&CO, to expand its presence in the UK and Ireland. The deal is valued at £475 million, with an additional pay-out structure dependent on the business’ profits. The Compass share price is trading down by 0.28% at the time of writing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Compass Group is a global food service and catering company with a presence in 45 countries. The company provides services in various sectors, including education, healthcare, sports, and defense.

Rationale Behind the Deal

Based in Reading, CH&CO caters to multiple sectors and is also a Royal warrant holder, serving at locations like the Royal Opera House and Abbey Road Studios.

With the deal, Compass aims to leverage CH&CO’s robust brand power and extensive geographic presence, which could help it capture a higher market share in the region. Meanwhile, CH&CO believes the deal provides a big growth opportunity for its clients.

For the full year FY23, Compass Group reported a revenue of £31 billion on a statutory basis. The company’s operating profit stood at £1.9 billion. For FY24, the company anticipates achieving underlying operating profit growth of about 13%. This growth is expected to be driven by high single-digit organic revenue expansion and a continued progression in margins.

The finalization of the proposed acquisition is subject to regulatory approval.

Is Compass Group a Good Stock to Buy?

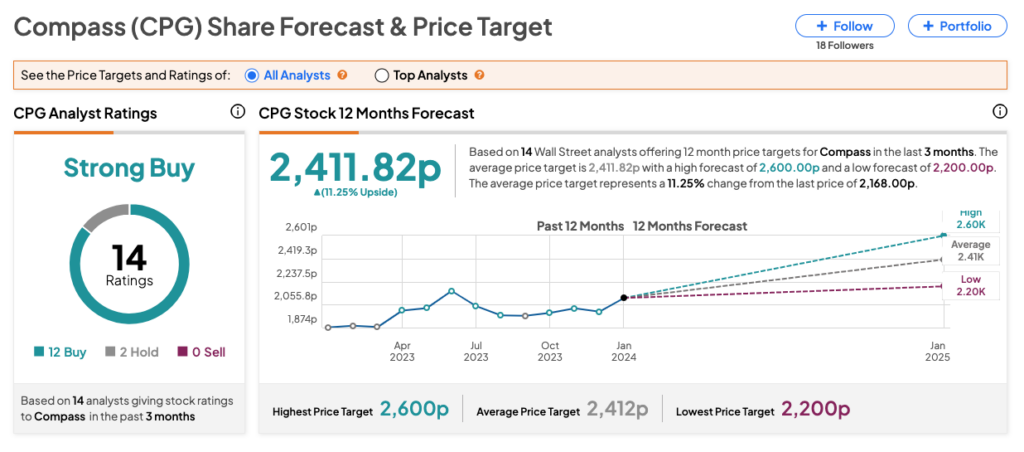

Overall, analysts hold a bullish view on CPG stock, as evidenced by its Strong Buy consensus rating on TipRanks. This includes 12 Buy and two Hold recommendations. The average Compass share price prediction is 2,411.82p, which is 11.25% higher than the current trading level.