Deutsche Lufthansa AG (DE:LHA) is among the leading airlines in Europe. It is the flag carrier of Germany and has global operations. After getting hit by the pandemic, Lufthansa is back on track with its recovery in passengers as well as the share price.

The stock has been trading up and has gained 48% in the last six months. As the company is set to announce its Q1 2023 earnings next month, we have analyzed the stock on parameters like Website Traffic, Analyst Ratings, and more.

Let’s have a look at some details.

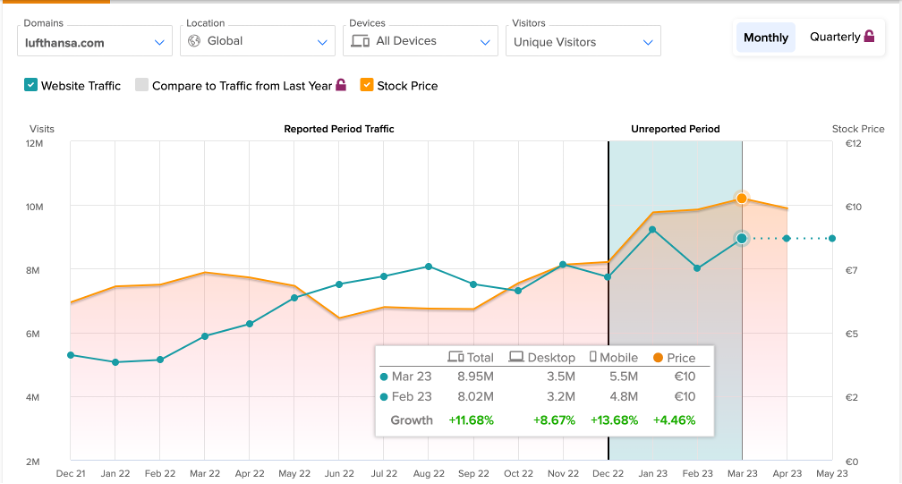

Website Traffic

According to TipRanks’ Website Traffic tool, Lufthansa has witnessed a growth in its visitors, resulting in more passengers. The total number of visits to lufthansa.com increased by 11.68% in March 2023 as compared to the previous month. For February, this growth number was negative 13.18%.

The total number of unique visitors grew by 50% in 2022, to 7.74 million in December 2022, up from 5.07 million in January 2022.

This growth was visible in its 2022 results, where it catered to 102 million passengers as compared to 47 million passengers in 2021. The company was also able to turn around its losses and generate an EBIT of €1.5 million in 2022. The company will report its first-quarter earnings for 2023 on May 3, 2023.

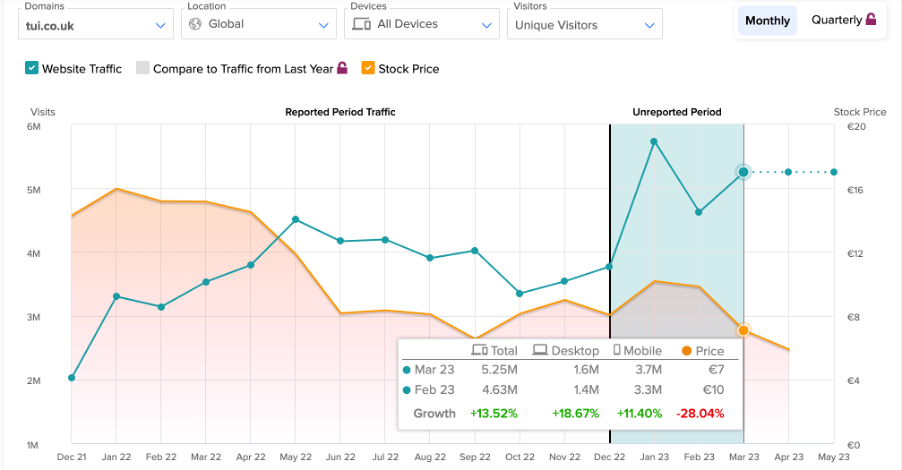

Competition

TUI AG (DE:TUI1) is one of the major travel and tourism companies in Germany. The company’s operations include hotels, resorts, and cruise lines, and it has a presence in more than 180 countries.

As per the Website Traffic tool, TUI’s visitors have grown by 13.5% in March 2023, as compared to the previous month. However, the stock price is not growing in sync with these growth numbers. In the last year, the stock has been on a downward journey and has lost more than 60%.

On TipRanks, TUI1 stock has a Moderate Sell rating, with a downside of around 3% in the share price.

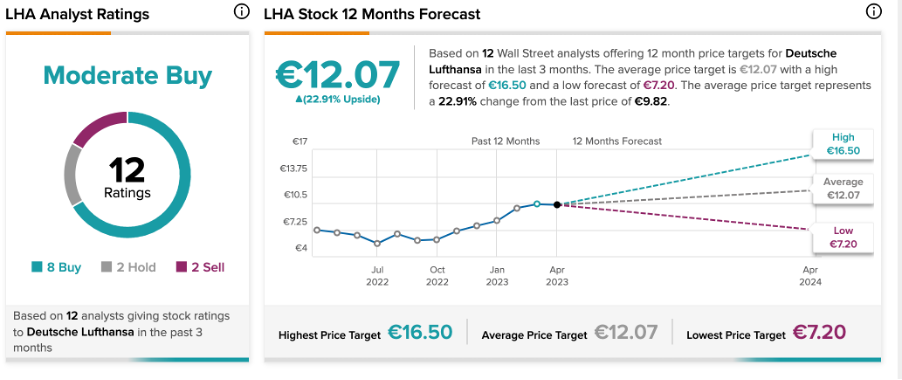

Deutsche Lufthansa Stock Prediction

Yesterday, analyst Johannes Braun from Stifel Nicolaus upgraded the rating to Buy from Hold at a price target of €6.92, implying an upside of 18%. He believes strong travel demand, improved capacity, and higher pricing should lead to stable profits.

According to TipRanks’ analyst consensus, LHA stock has a Moderate Buy rating based on a total of 12 recommendations, of which eight are Buy.

The average price prediction is €12.07, which is 23% higher than the current price level.

Conclusion

Lufthansa, with its dominant position in Europe, is well-placed to take advantage of the changing trends in the global travel sector. The improved data from the websites suggests another set of strong results for the company.