Volatile share prices are the scariest words in the minds of investors across all markets right now. During this time, the investors are waiting for any positive signal around a stock, which can guide their investment decision.

Well, if the investors go through the tools provided by TipRanks in various markets, they will find enough signals to pick the correct stocks. For example, when corporate insiders are buying their own company’s stock, it is a clear indication of a buying opportunity.

Let’s discuss two ASX stocks and find out about the recent insider transactions.

Aristocrat Leisure Limited (AU:ALL)

The company has a big name in the gaming technology industry and has a presence in over 20 locations globally. The stock is currently on a downward trajectory, having fallen by 26.3% in the last year. However, the insider’s buying activities suggest that the stock has upside potential in the future.

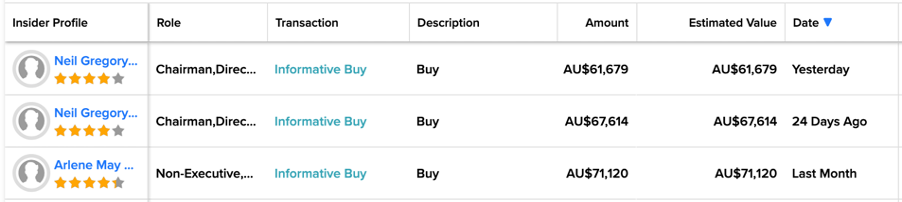

According to the TipRanks data, Aristocrat has a positive signal on insider confidence. The insiders have bought shares worth $137.1k in the last three months.

Aristocrat’s chairman and director, Neil Gregory Chatfield, yesterday bought 2000 shares worth AU$61,679 in the company. Prior to this, he bought the same number of shares in December 2022, worth AU$67,614.

Another insider is the company’s director, Arlene May Tansey, who bought 2000 shares for a value of AU$71,120.

All these transactions were informative buys, which implies that they were made for reasons that indicate confidence in the stock.

Aristocrat Leisure Share Price Forecast

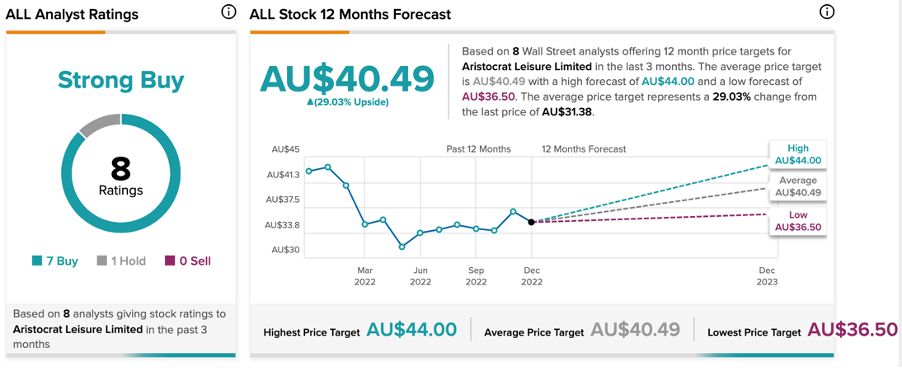

On TipRanks, Aristocrat Leisure stock has a Strong Buy rating, based on seven Buy and one Hold recommendations.

The ALL target price is AU$40.5, which represents a 29% change in the price from the current level.

Fortescue Metals Group Limited (AU:FMG)

Fortescue Metals, an iron-ore mining company based in Australia, has seen its stock rise 200% in the last three years. This was mainly driven by higher energy prices.

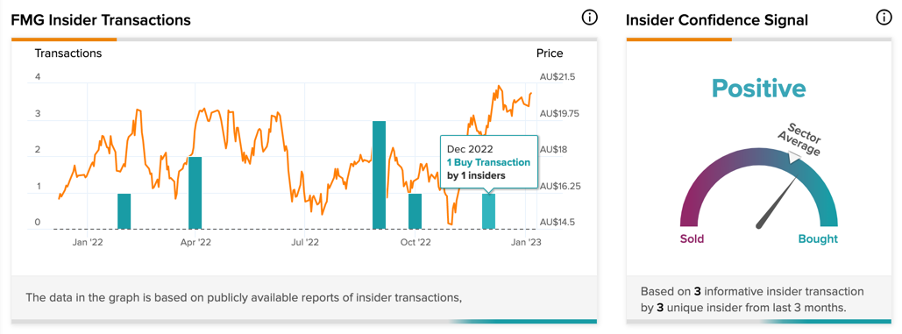

Currently, analysts don’t see any further upside in the share prices. However, the insiders are still accumulating more shares.

According to TipRanks data, corporate insiders have bought shares worth $66.7k in the last 3 months. Also, the insider confidence signal is positive.

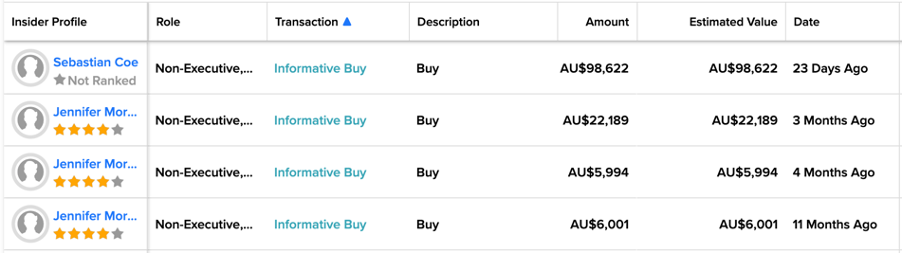

Talking about more details, the company’s non-executive director, Sebastian Coe, bought 5,000 shares in the company in an informative buy transaction. He bought the shares for AU$19.7 in a transaction valued at AU$98,622.

Further shares were purchased by another non-executive director, Jennifer Morris, in August and September 2022. Overall, she bought shares worth AU$34,184 in the last year.

Is Fortescue Metals Group a Good Stock Pick?

According to TipRanks’ analyst consensus, Fortescue Metals’ stock has a Moderate Sell rating. The average target price is AU$15.9, which is 27.3% lower than the current price level.

Conclusion

Tracking such insider activities could be a beneficial strategy for investors. The insiders are in a better position to judge the outlook of the company’s stock price.

The TipRanks tool provides detailed information on such insider activities that are mostly hidden from retail investors.