Using the Top Dividend Shares tool for the UK market, we have shortlisted two companies offering good dividend payments. These companies have strong positions in their respective industries and are known for stable dividends over the years.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Investing in dividend stocks not only guarantees extra income but also offers capital appreciation in the long run. According to analysts, these companies also offer decent growth in their share prices.

Let’s take a look at these companies in detail.

Imperial Brands (GB:IMB)

Imperial Brands is among the leading tobacco manufacturers in the world and owns famous brands like West, Davidoff, Winston, Pulze, iD, etc.

IB has been able to increase its dividends every year since 2012. The company has the advantage of a solid top line and high cash generation to support its revenues. The company recently paid total dividends of 141.17p per share in 2022, including a final dividend of 49.32p per share paid in March.

With the current dividend yield of 7.57%, a strong portfolio of established brands, and growing cash flows, IMB stock remains a quality pick for income investors.

What is Imperial Brands’ Target Price?

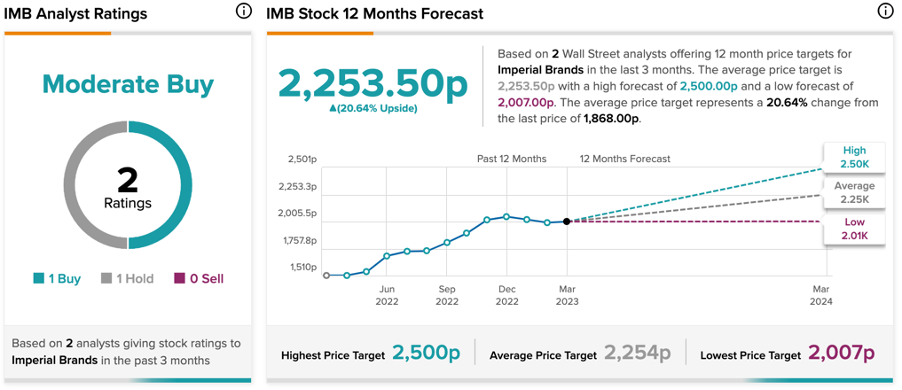

According to TipRanks, IMB stock has a Moderate Buy rating.

The average target price is 2,253.5p, which implies an upside of 20.6% from the current level.

Rio Tinto (GB:RIO)

Rio Tinto is a mining group that processes mineral resources like iron ore, copper, lithium, diamonds, and many more.

The last year’s stock price performance depicts the volatility in commodity prices. The company also posted rough financial results in its 2022 earnings report, driven by weaker commodity demand and prices. However, the free cash flow of $9.0 billion allowed the company to facilitate further investments along with a stable dividend payment.

In sync with its 60% payout policy, the company paid a total dividend of $4.92 per share in 2022. Even though the payments are lower as compared to the previous year, the dividend yield of more than 9% is still attractive.

Goldman Sachs (NYSE:GS) expects the company to continue its dividend run for the next two years. The investment bank forecasts a dividend of $5.33 per share in 2023 and $5.98 per share in 2024.

Rio Tinto Share Price Forecast

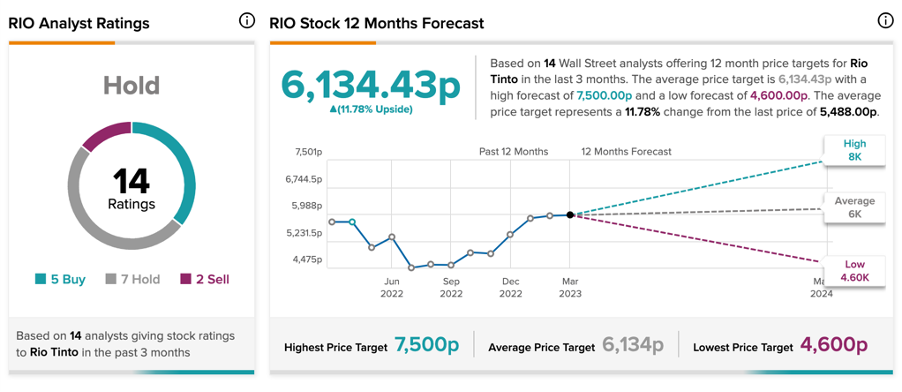

Based on a wide coverage from a total of 14 recommendations, RIO stock has a Hold rating on TipRanks.

The average target price of 6,134.43p suggests a growth of 12% on the current price.

Conclusion

The current downfall of the stock market creates a great opportunity to stock up on dividend shares. And adding more such stocks could boost the portfolio.

Both RIO and IMB are backed by strong cash flow, which makes their dividend stories more sustainable.