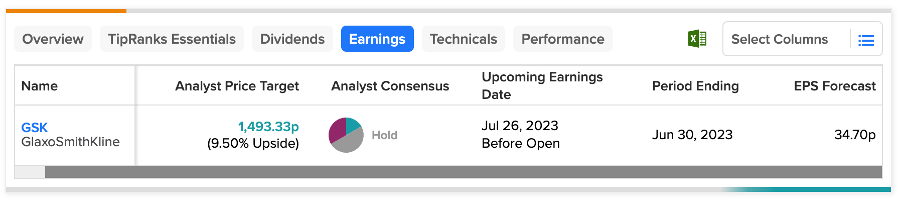

GlaxoSmithKline PLC (GB:GSK) will announce second-quarter earnings for 2023 next week on July 26. According to TipRanks, the consensus EPS forecast is £0.35 per share, which is similar to the EPS reported in the same period last year. Ahead of the earnings, analysts have taken a cautious approach to the stock and have rated it as a hold.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

GlaxoSmithKline is a healthcare company involved in the research, development, and production of pharmaceutical medicines and vaccines. The company holds a substantial market share in the global vaccine market.

GSK is anticipated to show a decrease in earnings compared to the previous year, attributed to lower revenues for the second quarter. The sales forecast for the next quarter is £6.82 billion, slightly down from the last quarter’s sales of £6.95 billion.

During its first-quarter earnings, the company reaffirmed its full-year 2023 guidance and declared a dividend of 14p for Q1 2023, with an expected dividend of 56.5p for the full-year 2023. The company is confident of achieving its quarterly and yearly numbers for 2023 based on its strong results in Q1 2023. It is committed to upcoming launches, such as a potential RSV older adult vaccine, and is dedicated to enhancing its pipeline further.

Analysts’ View

Before its earnings release, analysts’ opinions on the stock were divided, leaning more towards a bearish outlook.

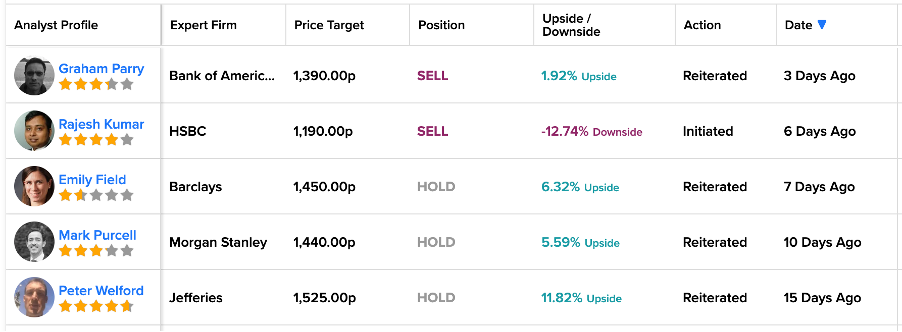

Three days ago, analyst Graham Parry from Bank of America Securities confirmed his Sell rating on the stock, with a modest increase of 1.92% in the share price.

Prior to that, six days ago, HSBC analyst Rajesh Kumar initiated a Sell rating on the stock, predicting a decline of 12.7% in the share price.

Other analysts from Barclays, Morgan Stanley, and Jefferies also confirmed their Hold rating on the stock over the last 15 days. These analysts are also predicting a moderate increase in the share price, ranging from 6% to 12%.

Is GlaxoSmithKline a Good Buy?

According to TipRanks, GSK stock has a Hold rating backed by a total of 12 recommendations. It includes two Buy, six Hold, and four Sell recommendations.

At an average price target of 1,493.3p, analysts predict an upside of 9% on the share price.