FTSE 100 company Taylor Wimpey PLC (GB:TW) posted lower numbers in its half-yearly earnings for 2023 amid a slowdown in the UK housing market. Both revenues and profits were down as higher interest rates subdued demand in the residential property market. The company, however, described its first-half performance as “resilient.”

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Following the news, its shares surged over 4% to 118p on Wednesday, leading the stock to the top of the housing sector index. This gain comes after a 9% decline in the stock over the last three months.

The Struggling Housing Market

Following the Bank of England’s interest rate hike aimed at controlling inflation, Britain’s housing market has experienced a decline in house prices and reduced buyer demand. As a consequence, some homebuyers are resorting to longer mortgages to manage the increased borrowing expenses. Taylor Wimpey reported that in the first six months of 2023, 27% of its first-time buyers opted for mortgage terms exceeding 36 years, a notable increase from the 7% recorded in 2021.

Taylor Wimpey completed 5,120 homes during this period, which shows a decrease from the 6,922 homes completed during the same period a year ago. As a result, the company reported a pre-tax profit of £237.7 million, representing a 28.9% decline compared to the previous year. On the plus side, the average selling price rose by 6.7% to £320,000 from last year.

Potential Recovery Ahead

As we approach the end of 2023, the company is seeing some signs of moderation in inflation and anticipates this trend to continue. It continues to prioritize building a robust order book to enhance its pricing strategy for the year 2024. As of July 30, 2023, the company’s order book was worth £2,147 million with 7,866 homes.

The company remains committed and is not planning to reduce the number of houses it intends to build in 2023. It anticipates full-year UK completions to fall within the range of 10,000 to 10,500, which is at the higher end of its previous guidance. The group expects its operating profit, including joint ventures, to fall within the range of £440 million to £470 million. Furthermore, the net cash balance at year-end 2023 is expected to be in the range of £500 million to £650 million.

What is the Price Target for Taylor Wimpey?

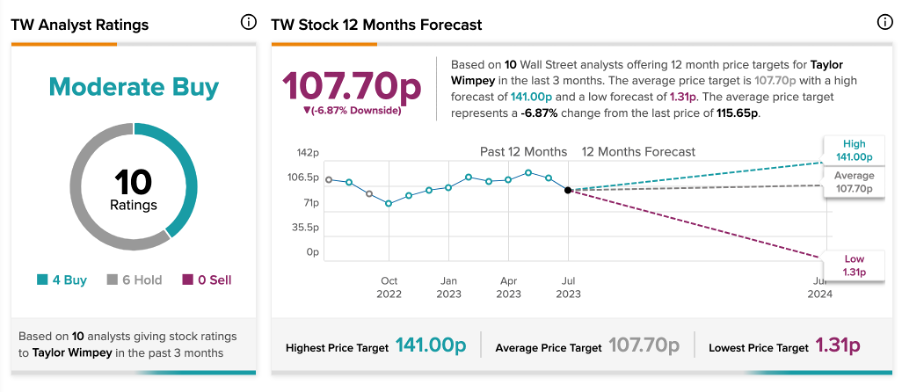

On TipRanks, TW stock has a Moderate Buy rating based on four Buy versus six Hold recommendations. The average target price of 107.7p implies a downside of 6.8% in the share price.