UK-based insurer Prudential PLC (GB:PRU) saw its share price gain some momentum after the company delivered a strong performance in its half-year earnings for 2023. Along with the results, the company also provided a strategy to achieve its five-year goals by 2027.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

At the time of writing, the shares were trading up by 3%, leading the FTSE 100 index. On the whole, the shares are not in their best zone and have experienced a loss of 12.5% year-to-date. The UK insurance sector is grappling with difficulties due to higher claim costs and economic uncertainties, which have exerted downward pressure on the share prices of companies like Prudential and its rivals.

Half Year 2023 Results

The company’s new business profit grew 39% to $1.49 billion, with double-digit expansion in 16 of its markets. APE (annual premium equivalent) sales grew by 42% to $3.03 billion. Notably, APE sales from the domestic segment witnessed a remarkable 68% growth. During the first half, Hong Kong exhibited a solid performance, driven by higher demand for savings products and increased market share for prudential.

The adjusted operating profit increased by 6% to $1.46 billion, with more Chinese visitors buying insurance after the country ended its COVID-19 restrictions.

For the period between 2022 and 2027, the company’s objective is to achieve a compound annual growth rate of 15%-20% in new business profit. The company is also targeting “double-digit compound annual growth” in operating free surplus.

Analysts’ Reactions

Analysts have expressed their optimism over the results and expect the momentum to continue in the next quarters as well. Analyst Philip Kett from Jefferies wrote, “Hong Kong was the standout geography.” He stated that the unexpected momentum in the domestic market is particularly reassuring, especially considering the intense competition from rivals.

Citi analyst Andrew Baker also praised the results and expects the modest outperformance of the company, along with the introduction of new financial targets, to drive growth.

Post-results, Andrew Sinclair from Bank of America Securities reiterated his Buy rating on the stock, predicting an upside potential of 33%.

Is Prudential a Good Stock to Buy Now?

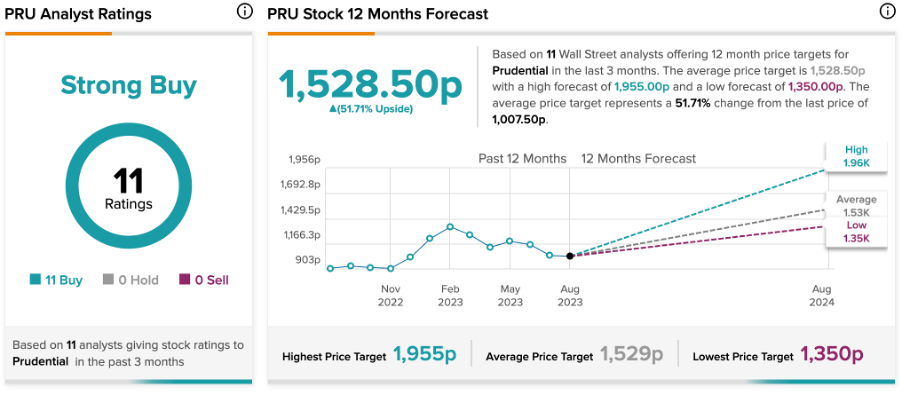

According to TipRanks, PRU stock has a Strong Buy rating, backed by Buy recommendations from all 11 analysts. Furthermore, the Prudential share price target of 1,528.5p implies a huge upside of 51.7% from the current trading level.