FTSE 100 company Admiral PLC (GB:ADM) today announced a dividend cut after it posted modest profit growth in its first-half earnings for 2023. Despite the current challenging market conditions, the company was able to post high turnover growth, driven by more customers and price hikes. On the other hand, the company reduced its interim dividend from 60p per share last year to 51p in these results.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Based in the UK, Admiral PLC is a financial services company that serves around 9.4 million customers. The company is mainly known for its insurance services and is a leading insurer in the UK market.

Post-earnings announcement, the shares have gained more than 6% in today’s trading at the time of writing. YTD, the shares have experienced fluctuations but have managed to secure an approximate 9% gain.

Admiral’s Impressive Half-Yearly Results

The group’s turnover increased by 21% to £2.24 billion in the six months of 2023, as compared to £1.85 billion last year. The insurance revenue also demonstrated substantial growth, reaching £1.61 billion, marking a robust 14% increase over the corresponding figure from the prior year.

The company was able to increase its customer base by 4% to 9.41 million within the framework of a challenging market. Nevertheless, the count of insured vehicles in the UK market decreased by 7% to 4.76 million, which was offset by high prices. The pre-tax profits experienced a 4% upswing, reaching £233.9 million, primarily driven by the implementation of heightened prices ahead of its competitors in 2022.

On the contrary, the 15% reduction in its interim dividend reflects the ongoing pressures of still-high inflation.

What is the Price Prediction for Admiral Stock?

Analysts believe market conditions will remain troublesome for the second half of 2023. However, Admiral should be able to beat that and continue with its strong performance, backed by its pricing policy, cost management, and focus on mid-term profitability.

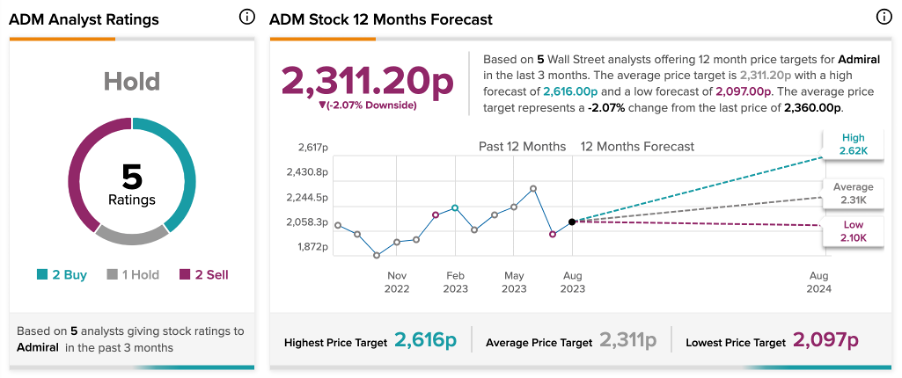

Prior to the results, analysts had a cautious approach to the company’s performance and stock. They have rated the ADM stock as a Hold, based on two Buy, two Sell, and one Hold recommendations. The average target price of 2,311.2p implies a downside of 2.07% in the share price.