UK-based energy giant BP PLC (GB:BP) has consistently attracted the attention of analysts and investors as a prominent player in its sector. In recent years, the stock has garnered even more interest due to its increasingly proactive shift towards clean energy. This has also impacted the company’s financial performance due to heavy investments in alternative energy.

Over the past year, the stock has delivered a return of 17.3%, building upon the impressive growth of nearly 80% achieved over the last three years.

BP is a global energy company engaged in the production of oil and natural gas. The company supplies customers with fuel, energy, lubricants, and petrochemicals, with operations across all major continents.

Let’s take a look at some details.

The Upside Case

Considering its status as a leading energy company, BP has exhibited impressive performance over the past two years, successfully navigating the decline in oil prices from their peak in 2022. Analysts remain bullish as the shares are currently priced attractively, with the added support of management’s stock buyback activities. Furthermore, there is a possibility of increased cash returns to shareholders in 2023.

On the flip side, the primary risk to the current outlook lies in a potential recession in 2023 or beyond, which could significantly impact oil demand.

On May 2, the company announced its first-quarter earnings for 2023, followed by a year of substantial profits. The company reported first-quarter profits, showing an increase from the previous quarter but lower compared to the exceptional levels achieved during the remarkable year 2022. The company posted an underlying replacement cost profit of $4.96 billion for the quarter, higher than the analysts’ expectations of $4.3 billion.

The higher numbers were driven by strong performance in oil and gas trading. The company also announced an additional share buyback program worth $1.75 billion and expects it to be completed before August 2023.

Is BP a Good Stock to Buy Right Now?

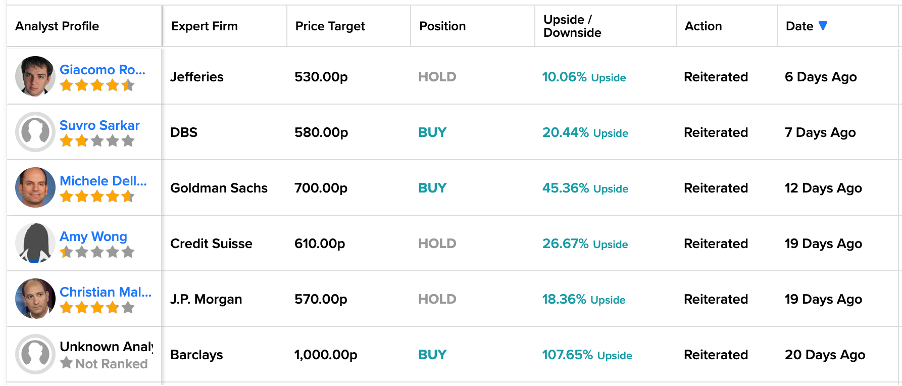

Following the release of the results, analysts have shown their support for the stock and reaffirmed their ratings over the past 20 days.

Among these, Barclays analyst has the highest price target on the stock at 1,000p, with a prediction of more than 100% upside. 20 days ago, Barclays reiterated its Buy rating on the stock.

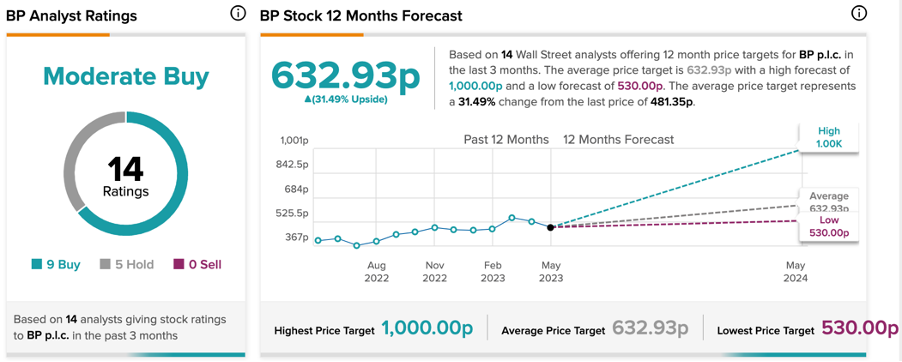

According to TipRanks’ rating consensus, BP stock has a Moderate Buy rating. The projected average price for the stock is 632.9p, indicating an upside of 31.5% from the current level.

The Bottom Line

BP is dedicated to providing value to our shareholders through more investments, decreased net debt, and increased distributions. The stock’s Buy ratings from analysts and their confidence in its potential make it an appealing choice to consider.