UK-based companies Entain PLC (GB:ENT) and Vodafone Group (GB:VOD) made headlines yesterday with their deals, solidifying their position among investors.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

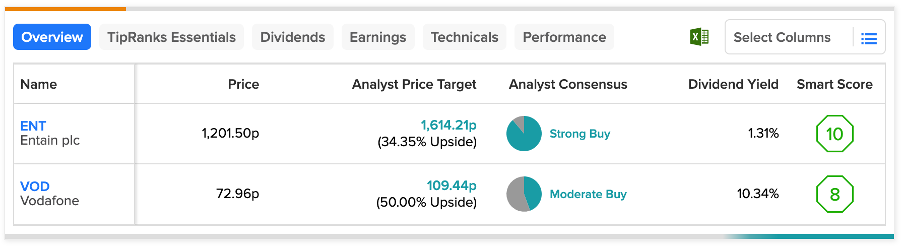

Overall, Entain has received a Strong Buy rating from analysts, while Vodafone has been assigned a Moderate Buy rating. The stock prices of these two companies are projected to increase by more than 30% in the next year.

Let’s take a look at their deals.

Entain PLC

Entain is a global gaming and sports betting company with operations in around 20 countries. The company’s brands include Bwin, Coral, Ladbrokes, Partypoker, Partycasino, and more.

Yesterday, Entain announced its acquisition of Poland-based betting company STS Holdings for £750 million. The company also raised £600 million through a placing and an open offer to fund a part of this acquisition. This acquisition aligns with the company’s strategy to acquire exceptional businesses that hold top positions in thriving, regulated markets with substantial growth potential. Entain is looking to enhance its European expansion, by incorporating the Polish operator into its portfolio.

Entain’s CEO, Jette Nygaard Anderson, commented, ”Expansion across Central and Eastern Europe remains a core component of our growth plans, and STS will be an integral part of our platform in that region.”

Post-announcement of this news, J.P. Morgan’s analyst Estelle Weingrod confirmed her Buy rating on the stock.

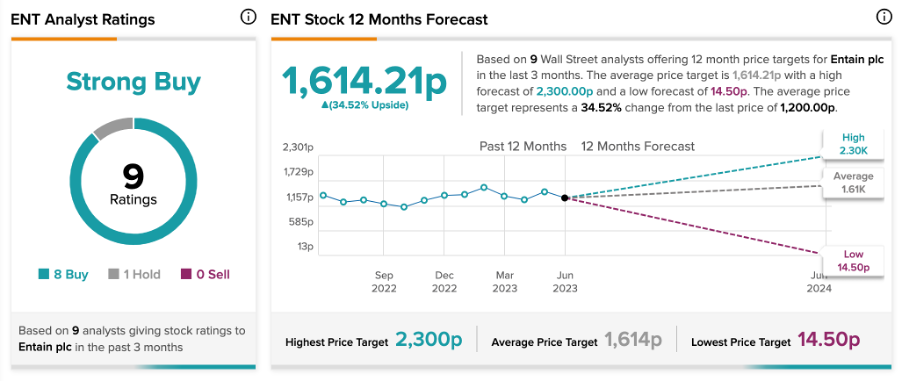

Is Entain PLC a Buy or Sell?

On TipRanks, ENT stock is rated as Strong Buy based on eight Buy and one Hold recommendations. At an average price target of 1,614.2p, analysts expect a growth of 34% in the share price from the current level.

Vodafone Group PLC

Leading European telecommunications company Vodafone Group yesterday announced its long-awaited merger with CK Hutchison to combine their UK operations. The merger is set to establish the largest mobile operator in the country.

The combined entity will be owned 51% by Vodafone and 49% by Hutchinson and cater to around 27 million customers. These two conglomerates expressed their commitment to invest a total of £11 billion in the UK over the next decade to develop the most advanced 5G network in Europe.

Analysts see this merger as a promising prospect for Vodafone’s share price, considering the synergies and increased financial resources to invest in innovative initiatives. The companies project annual savings exceeding £700 million within the fifth year following the completion of the merger.

Vodafone Share Price Forecast

Based on a total of nine recommendations, VOD stock has a Moderate Buy rating on TipRanks. This includes four Buy and five Hold ratings.

The average target price is 109.44p, which is 50% above the current trading level.

Conclusion

Analysts were bullish on both ENT and VOD stocks. However, the recent deals have reinforced and strengthened their positions within their respective industries. With Buy ratings, analysts consider them valuable additions to investors’ portfolios.