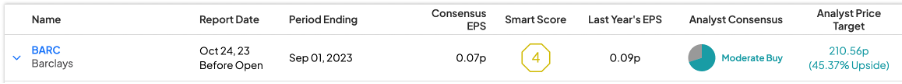

The earnings season for UK banks is about to kick off this week, with all four major banks scheduled to report their Q3 numbers. Barclays PLC (GB:BARC) is at the forefront of this earnings season, with its Q3 2023 earnings scheduled on Tuesday, October 24. According to TipRanks analysts’ consensus, the EPS for the quarter is expected to decline to £0.07 from £0.09 in the same quarter a year ago.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The UK banks have been enjoying a period of high net interest margins (NIM), driven by elevated interest rates from the Bank of England (BoE). However, the impact of high interest rates on banks has been mixed, as it has also led to increased impairment provisions, which will be a key focus area in the upcoming earnings season. Apart from these, loan demand and customer deposits are also anticipated to be in the spotlight.

The TipRanks Earnings Calendar tool is a valuable resource for tracking companies with upcoming earnings announcements. This tool is available in nine different markets and could assist investors in staying updated and making more informed decisions about their investments.

Let’s take a look at the details.

Barclays Q3 2023 Results: Focus on Investment Banking

Barclays is one of the top four banks in the UK, serving approximately 48 million customers worldwide. The bank offers a wide range of services, including retail and corporate banking, wealth management, investment banking, and more.

In Q3, analysts expect the bank to post pre-tax profits of £2 billion, similar to the number posted in the second quarter of 2023. The revenue for the third quarter is anticipated to reach £6.35 billion. For Barclays, one of the key focus areas will be its investment banking division, especially after its U.S. counterparts reported solid performance in this segment. In the second quarter, the bank’s CIB (corporate and investment bank) segment reported a 3% decline in its income of £3.2 billion, mainly due to reduced customer activity in global markets.

Ahead of its earnings, three days ago, Morgan Stanley analyst Alvaro Serrano reiterated his Buy rating on the stock, forecasting a 58% growth in the share price. Serrano is bullish on the bank’s CIB segment and sees an upside to his forecasted numbers. He added that even though the outlook for this segment is uncertain, the overall market trends are encouraging.

Last month, Serrano upgraded his rating on the stock to Buy after a huge gap of six years. He is also bullish on the bank’s expansion and growth in the U.S. credit card industry, which is anticipated to enhance its profitability and give it an edge over its rivals.

Are Barclays Shares a Good Buy Now?

After a rough first half, the bank’s share price has stabilized within a narrower range. However, the stock still has a long way to recover after being impacted by the U.S. regional banking crisis in March 2023. Year-to-date, the stock has been trading down by 7.15%.

BARC stock has been assigned a Moderate Buy rating on TipRanks based on seven Buy versus three Hold recommendations. The Barclays share price target is 210.56p, which implies an upside potential of 45.4%.