The DAX 40 stocks Deutsche Telekom (DTE) and Munich Reinsurance (MUV2) will announce the final quarter as well as annual earnings for 2022 this week. Analysts remain upbeat on these companies and have rated their stocks as Buys.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Analysts have predicted lower EPS and sales numbers for Deutsche Telekom, but they remain optimistic about the long-term potential of the stock.

Munich Re has higher forecasted EPS for the fourth quarter, and the company also expects its gross premiums to increase for the full year of 2022.

The TipRanks Earnings Calendar tool for Germany is useful for investors looking for upcoming earnings dates of companies in this market. The tool consolidates the earnings date, EPS forecast, and other data points in one place for a quick and updated round of information.

Let’s have a look at these companies in detail.

Deutsche Telekom AG

As a leading telecommunications provider in Europe, Deutsche Telekom provides fixed and mobile networks, internet, and IPTV services to customers. The company has operations in around 50 countries.

The company will report its Q4 and full-year results for 2022 on February 23. For the quarter, the forecasted EPS is €0.19 per share, with a range of €0.16 to €0.22 per share. The forecast came in lower as compared to an EPS of €0.26 per share in Q4 of 2021. According to TipRanks, the company’s sales forecast is around €29.26 billion for the fourth quarter, slightly up from the sales of €28.9 billion in the previous quarter.

Analysts believe the stock is backed by the company’s solid business model, its presence in the U.S. market, and consistent dividend payments.

Ahead of its earnings, the majority of analysts have reiterated their Buy ratings on the stock.

Is Deutsche Telekom Stock a Buy?

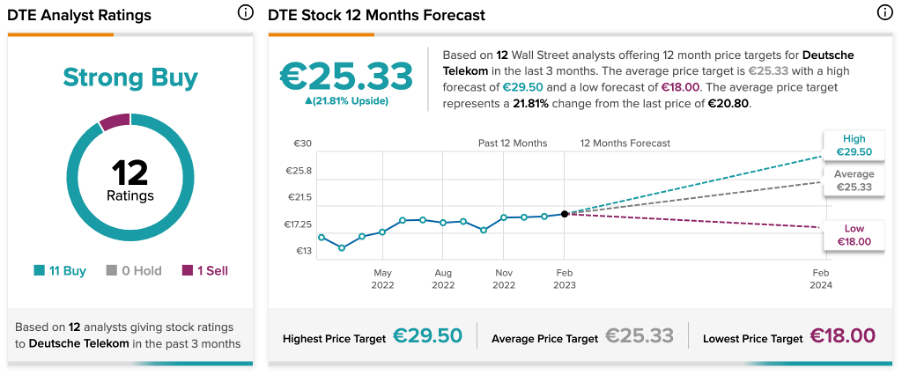

According to TipRanks’ rating consensus, DTE stock has a Strong Buy rating.

The average price forecast is €25.33, which shows a change of 21.8% from the current price.

Munich Reinsurance Company (Munich Re)

Munich Re is a German multinational company that provides insurance, reinsurance, and other insurance-related risk solutions to its customers.

The company will report its fourth-quarter results on February 23, and the forecasted EPS is €9.31 per share. This shows a good improvement over the previous year’s EPS of €6.2 in the same quarter. Analysts expect sales of €16.48 billion in Q4.

The company will also announce its annual results for 2022. The company has raised its annual guidance numbers, considering the company’s favorable operational performance in the first nine months of 2022. The company expects a gross premium of €67 billion in 2022, up from €59.5 billion in 2021.

Munich Re Share Price Forecast

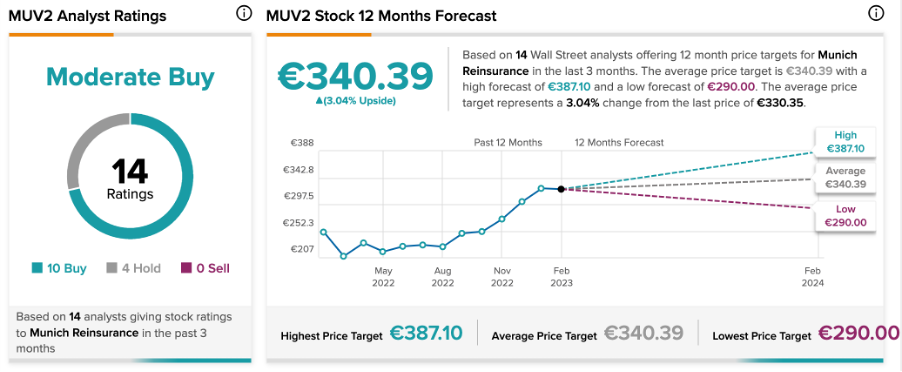

The stock has wide coverage from analysts on TipRanks, with a total of 14 recommendations. It includes ten Buy and four Hold recommendations.

Overall, MUV2 stock has a Moderate Buy rating. The target price of €340.39, shows a change of 3% from the current price level.

The stock has been trading up by almost 35% in the last year.

Ending Notes

Given the analysts’ positive outlooks on DTE and MUV2, investors could consider diversifying their portfolios with these German stocks.

Deutsche Telekom is expected to post lower earnings as compared to last year’s fourth quarter. It still remains a stock with long-term growth prospects, riding on a solid customer base and market grip in Europe.

Munich Re enjoys a dominant position in the reinsurance industry in terms of its premium generation. The company expects to deliver a strong set of results for 2022, driven by higher income across all its business segments.