German athleisure company adidas AG (DE:ADS) received a Buy rating confirmation from analysts at J.P. Morgan after it reported a big order for Yeezy shoes. The share price is also trading up 0.80% at the time of writing. YTD, the stock has gained 37% after touching a low point in November 2022.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

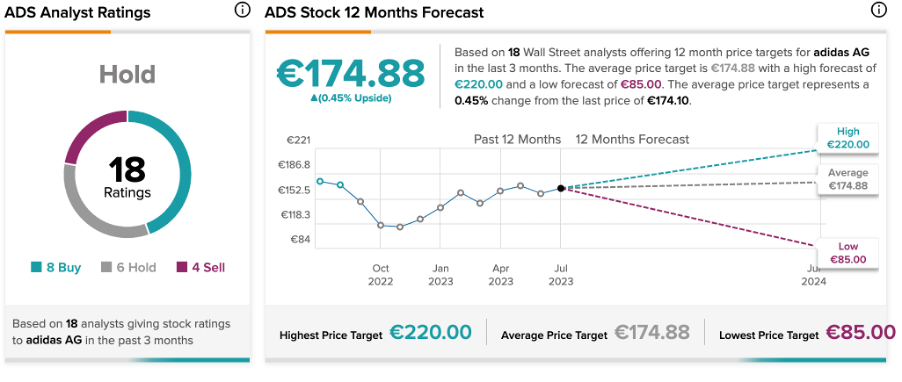

Overall, the stock carries a Hold rating from analysts on TipRanks.

The New Order

Taking a positive turn, shares of adidas surged after the Financial Times reported that the company received orders worth approximately €508 million for around 4 million pairs of unsold Yeezy shoes. The order value surpassed the company’s initial expectations, bringing joy to analysts and shareholders alike.

In October 2022, the company stopped selling Yeezy shoes as part of its terminated partnership with the rapper formerly known as Kanye West, following a series of “antisemitic comments” he made on social media and in interviews. The discontinuation of this highly profitable line had a significant impact on the company’s first-quarter sales, resulting in a decline of approximately $440 million. The company has also anticipated a loss for the full year 2023 before revealing its plans to sell the remaining Yeezy shoes.

However, now the order could potentially rescue the company from needing to make a substantial write-down on its remaining stock of shoes.

Post-announcement, analyst Olivia Townsend from J.P. Morgan maintained her Buy rating on the stock. She also increased her price target on the stock from €185 to €195, implying a growth of 12% in the share price.

Is it Good to Buy adidas Stock?

On TipRanks, ADS stock has a Hold Buy rating backed by a total of 18 recommendations. It includes eight Buy, Six Hold, and four Sell ratings.

The average price prediction is €174.88, which is almost similar to current trading levels and implies a change of 0.45%.