DAX-40 listed companies Deutsche Telekom (DE:DTE) and Infineon Technologies AG (DE:IFX) reported their quarterly earnings for 2023 in May with better-than-expected numbers. Analysts have expressed a favorable outlook on these stocks, rating them as Strong Buy. DTE is projected to have a potential upside of approximately 19%, whereas Infineon demonstrates the potential for over 30% growth in its share price.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s dig deeper into the numbers.

Deutsche Telekom AG

Deutsche Telekom is a prominent telecommunications company in Europe that offers an extensive range of products and services, including fixed-line, mobile, internet, and IPTV solutions.

The company reported its Q1 2023 earnings on May 11. The company’s earnings of €0.39 per share surpassed the estimate of €0.37 per share by analysts. The company reported adjusted earnings of €9.96 billion, surpassing the consensus estimate of €9.9 billion by a slight margin.

The telecommunications operator experienced a 0.5% increase in quarterly revenue, reaching €27.82 billion, as compared to last year. The positive numbers were driven by higher growth in Germany and improved performance from T-Mobile in the U.S. The company has also revised its 2023 guidance, raising its expectations for full-year adjusted EBITDA to €40.9 billion compared to the previous forecast of €40.8 billion.

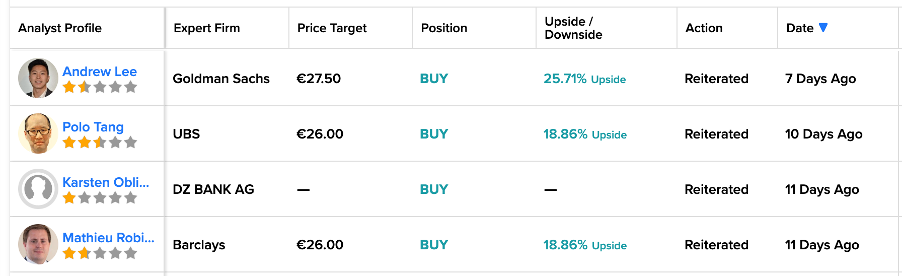

Post-results, a few analysts have re-confirmed their Buy ratings on the stock. Seven days ago, analyst Andrew Lee from Goldman Sachs reiterated his Buy rating, suggesting growth of 25.7% in the share price.

Deutsche Telekom Stock Forecast

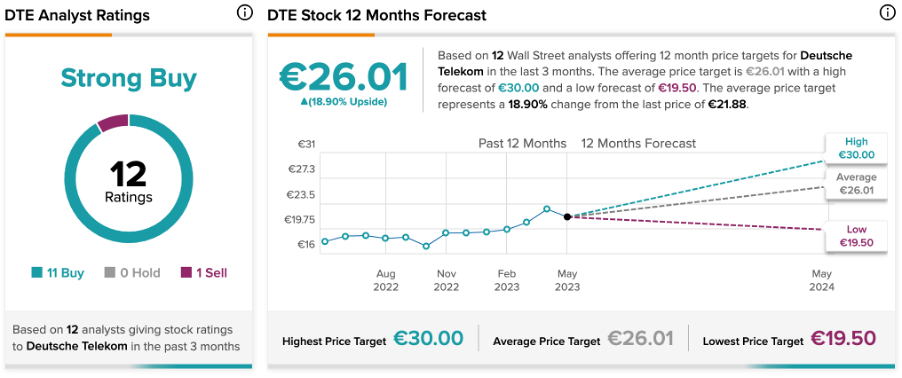

According to TipRanks, DTE stock has a Strong Buy rating with a total of 12 recommendations, of which 11 are Buy.

The average target price is €26.01, which represents a 19% change from the current price level.

Infineon Technologies AG

Infineon Technologies is a semiconductor manufacturing company catering to various sectors like automotive, industrial, telecom, security, etc.

The company released its second-quarter results for 2023 on May 4. The company delivered a quarter that exceeded expectations and also revised its outlook upward for the current fiscal year. The company posted a 25% growth in its revenues of €4.12 billion in Q2, as compared to the same quarter last year. During the quarter, the profit for the period showed improvement, rising to €826 million compared to €728 million in the previous quarter.

Infineon has also revised its revenue forecast for the full year to €16.2 billion, which was initially set at €15.5 billion.

The stock has received a lot of support from analysts since the results announcement. Today, UBS analyst Francois Xavier Bouvignies reiterated the buy rating on the stock with a prediction of a 36% upside in the share price.

Is Infineon Stock a Good Buy?

On TipRanks, IFX stock has a Strong Buy rating backed by 12 Buy, one Hold, and one Sell recommendations.

The average stock forecast is €47.51, which has an upside potential of 32.4%. The target price has a high forecast of €55 and a low forecast of €28.

Conclusion

DTE and IFX have demonstrated strong performances in their recent results and have expressed a positive outlook for the remainder of 2023. Moreover, analysts maintain a bullish perspective on their stocks, anticipating higher levels of growth.