The Commonwealth Bank of Australia (AU:CBA) is a leading retail bank in Australia that provides a wide range of financial services. The bank’s stock has been a beneficiary of the rising interest rates in the economy and has gained 86% in the last three years. However, in the last year, the stock has been volatile and has been trading down by 2.8%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Despite posting record profits in its Q2 2023 earnings, the shares went further down amid concerns about the bank’s mortgage business and interest margins already reaching a climax.

The Technical View

The overall summary of the technical indicators on the stock suggests a Buy signal in the time frame of one week. The summary includes technical pointers like oscillators and moving averages and indicates the overall technical strength of the stock. The summary has a total of 13 bullish, five neutral, and four bearish signals.

For the period of one week, the moving averages suggest the stock is a Strong Buy. The moving average is a commonly used indicator to study share price data. The different moving averages like 5, 10, 20, and 50 are perfect to study the trend changes in the share price in the short term.

CBA’s 10-day exponential moving average is 99.44, but the current trading price is AU$99.52, making it a Buy. On a longer time frame, the 100-day exponential moving average of the stock is 93.95, lower than the current price, suggesting a Buy. The stock’s other exponential moving averages for the 50-day and 200-day also indicate a Buy.

Contrary to moving averages, the relative strength index (RSI) of 49.58 recommends a Neutral action.

What is the Future of CBA Shares?

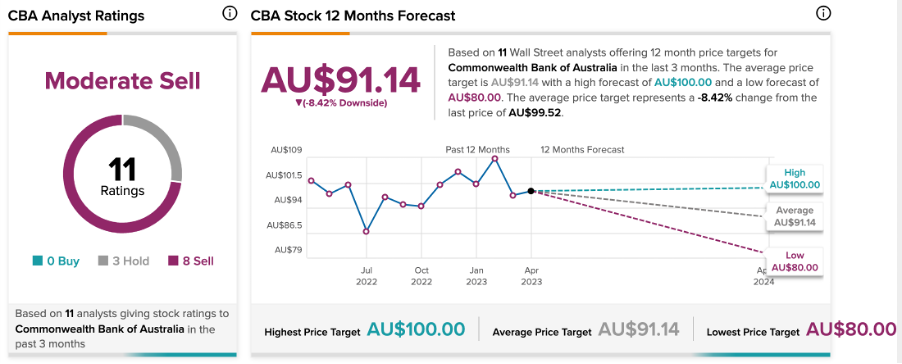

While the technical indicators are bullish, analysts have different viewpoints on the CBA stock. Based on a total of 11 recommendations, the stock has a Moderate Sell rating on TipRanks. It includes eight Sell and three Hold ratings.

The stock has an average price target of AU$91.14, which is 8.42% lower than the current price.