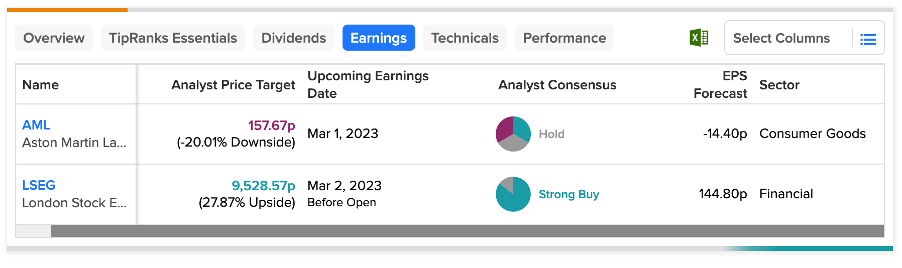

Aston Martin Lagonda Global Holdings (GB:AML) and London Stock Exchange (GB:LSEG) are set to announce their earnings for 2022 this week.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Aston Martin is on the recovery journey, and analysts expect modest growth in full-year numbers. However, analysts currently see no upside potential in the stock.

Whereas for LSE, analysts are bullish on the stock’s appreciation and expect strong results driven by its operational performance.

The TipRanks Earnings Calendar for the UK market provides all the updated information on upcoming earnings. Along with the dates, TipRanks also provides EPS and sales forecast numbers for the results. The earnings information can be filtered on different parameters, such as sector, rating, and market cap.

Let’s have a look at the details.

Aston Martin Lagonda Global Holdings PLC

Aston Martin is a luxury sports car manufacturer with strong brand names in its portfolio.

The company will report its FY22 results on March 1, 2023. Analysts expect “modest signs” of recovery in the company’s full-year results. Supply chain issues are expected to continue but could have reduced in Q4, along with strong demand for its products. According to TipRanks, the consensus EPS forecast is negative 0.14p for the fourth quarter.

Investment bank Goldman Sachs expects the company’s luxury car sales to be around £532 million in 2022.

The company has guided for deliveries in the range of 6,200–6,600 wholesale units for 2022. The Q4 results could also be well-supported by higher volumes and cash flows, driven by the company’s DBX707 and V12 Vantage models.

Aston Martin Stock Forecast

Aston Martin stock has rallied in the last three months, with a return of 53.3%. This could be one of the reasons that analysts don’t see any further upside in the share price.

According to TipRanks, AML stock has a Hold rating with an average target price of 157.67p.

London Stock Exchange Group

The London Stock Exchange Group is a financial markets infrastructure company with a diverse business model and multiple revenue streams.

LSE will report its preliminary results for 2022 on Thursday, March 02. Analysts’ consensus EPS for Q4 2022 stands at 1.45p compared to 1.41p in the same quarter a year ago. They expect Q4 sales to be around £1.93 billion.

Based on LSE’s strong performance in the first nine months of 2022, analysts are optimistic about the full-year numbers as well. In the third quarter, the company displayed strong performance across all its business segments and reconfirmed its guidance for the full year.

Ahead of the upcoming earnings, RBC Capital analyst Ben Bathurst reiterated his Buy rating on LSEG stock. His target price of 10,200p implies an upside of 37.2%.

London Stock Exchange Share Price Forecast

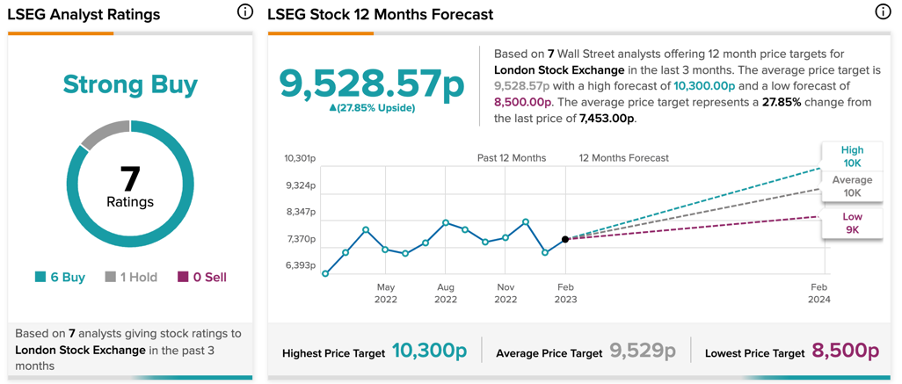

LSEG stock has a Strong Buy rating as per TipRanks’ analyst consensus. This is based on six Buy and one Hold recommendations.

The LSEG average target price is 9,528.5p, which is 27.9% higher than the current level. The target price has a high forecast of 10,300p and a low forecast of 8,500p.

Conclusion

Ahead of the upcoming earnings, analysts have mixed views about the two stocks. AML has a Hold rating with no further upside potential. On the other hand, LSE has a Strong Buy rating with more than 25% growth potential in its share price.