UK-based energy giants BP PLC (GB:BP) and Shell (GB:SHEL) are set to reveal their earnings for the first quarter of 2023 this week. Prior to the release of the results, analysts maintained a positive outlook on their stocks, with Buy ratings and a potential upside of over 15%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s explore further:

BP PLC

BP is a globally recognized energy company that offers a wide range of energy products and services to customers around the world.

The company will report its Q1 2023 earnings on Tuesday, May 2. As per TipRanks, the consensus EPS projection for the first quarter is 0.18p, which is lower than the EPS of 0.32p reported in the corresponding quarter of the previous year. According to analysts, the company is anticipated to disclose that its underlying replacement cost (RC) profit will be $4.27 billion in the first quarter of this year. The RC profit before interest and taxes is expected to be $7.97 billion, down from $19.15 billion in the previous quarter.

RBC Capital analyst Biraj Borkhataria said, “Given the volatility prevalent during the quarter, we expect oil and gas trading results to remain strong, though maybe not as ‘exceptional’ as they have been in some quarters in 2022.”

14 days ago, Borkhataria reiterated his Buy rating on the stock and predicted more than 20% upside.

Is BP PLC a Buy?

According to TipRanks’ analyst consensus, BP stock has a Moderate Buy rating based on a total of 14 recommendations. It comprises ten Buy and four Hold ratings.

The average share price forecast is 643.3p, which is 20.3% higher than the current price level.

Shell (UK)

Shell is a British company that specializes in oil and gas and offers various energy products, including fuels, oil, LPG, lubricants, and others, in global markets.

Shell is scheduled to disclose its Q1 2023 results on May 4, with analysts projecting an EPS of 0.84p for the same period. The company is anticipated to post adjusted earnings of $7.965 billion for the first quarter, which will be lower than the £9.1 billion it earned in the previous year.

The company is projecting increased production of liquefied natural gas (LNG) in Q1 following last year’s outages at its Australian facilities, along with steady earnings from LNG trading.

During the last 20 days, various analysts have maintained their optimistic outlook on the results and have restated their Buy recommendations for the stock.

Is Shell Stock a Good Buy Now?

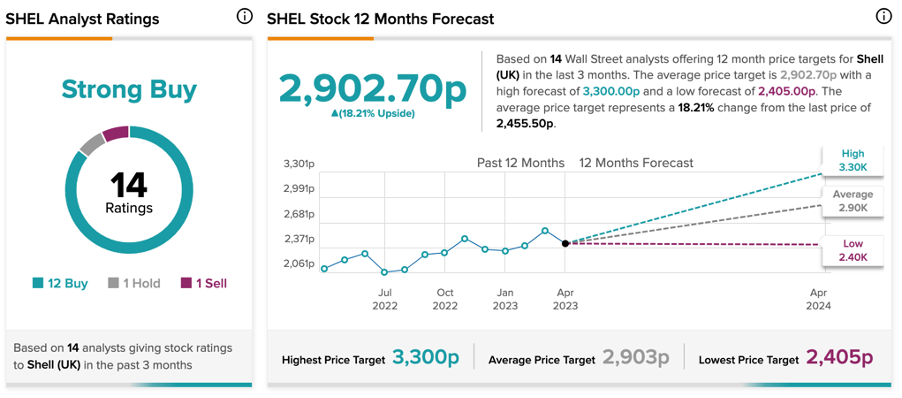

SHEL stock has a Strong Buy rating on TipRanks, based on 12 Buy, one Hold, and one Sell recommendations.

At an average target price of 2,902.7p, analysts are forecasting an increase of around 18% on the current price.

Conclusion

Analysts expect the first quarter numbers for both BP and Shell to be a little modest due to a decrease in oil and gas prices. Both companies’ shareholders are hoping for a slight positive earnings surprise that could potentially increase the value of their investments.