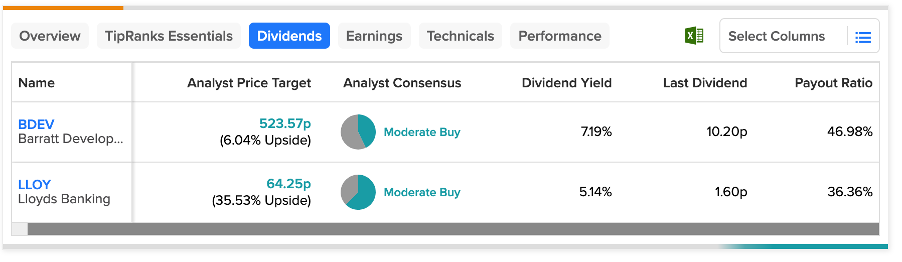

Using the Top Dividend Shares tool for the UK market, we have shortlisted Barratt Developments (GB:BDEV) and Lloyds Banking (GB:LLOY), which are part of the FTSE 100 index.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Along with higher dividends, Lloyds’ stock presents an attractive opportunity with over 35% potential growth in its share price, making it a complete package deal for investors.

On the contrary, Barratt is currently grappling with economic challenges in the housing market, which are impacting its profitability. As a result, the company is expected to decrease its dividend in the near term to align with its reduced earnings.

Let’s dig deeper into some details.

Barratt Developments PLC

Barratt Developments is a UK-based residential property builder engaged in various operations such as land acquisition, design, and construction, as well as sales and marketing. The company’s dividend yield stands at 7.24%, significantly higher than the industry average of 2.12%.

In 2022, the company paid a total dividend of 36.9p per share, which was covered by 2.25 times. However, for this year, the company has cut its interim dividend to align with its strategy of decreasing its dividend cover ratio to two times from 2.25 times in the previous year. The company recently paid its interim dividend of 10.2p, down from 11.2p in the last year.

Barratt is targeting to bring down its dividend cover to 1.75 times by 2024. This is mainly due to the company’s efforts to maintain stable dividends despite its declining profits.

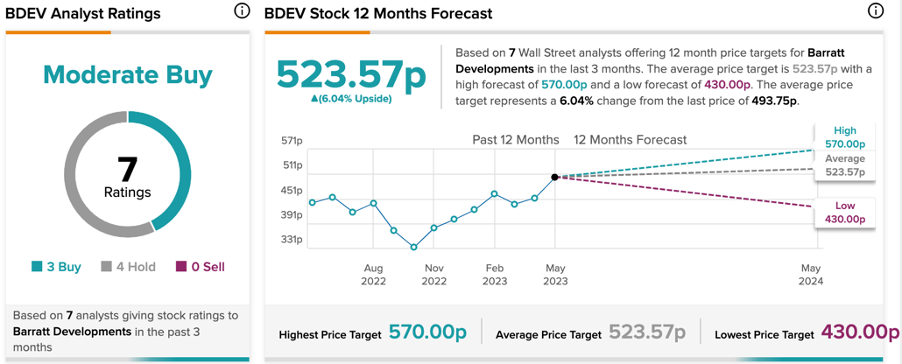

Barratt Share Price Forecast

According to TipRanks’ analyst consensus, BDEV stock has a Moderate Buy rating, based on three Buy and four Hold recommendations.

The average target price is 523.57p, which is 6% higher than the current price level.

Lloyds Banking Group PLC

Lloyds is among the leading financial institutions in the UK, offering a wide range of banking services to around 25 million customers.

The bank’s shares have delivered favorable returns to its shareholders in the last year, making them the favorite of retail investors in the UK. The shares had traded up by 13.27% in the last year.

Lloyds has delivered a trailing dividend yield of 5.1% in the past year, surpassing the broader FTSE 100’s yield of 3.7%. The bank paid a dividend of 2.4p per share in 2022, which is expected to increase to 2.8p in 2023 and further to 3.1p in 2024. Lloyds shares could be a compelling dividend choice in the FTSE 100, considering the potential rewards.

However, investors should be mindful that the bank’s focus on the UK economy, particularly the housing market, could entail a moderate level of risk in return for the expected benefits.

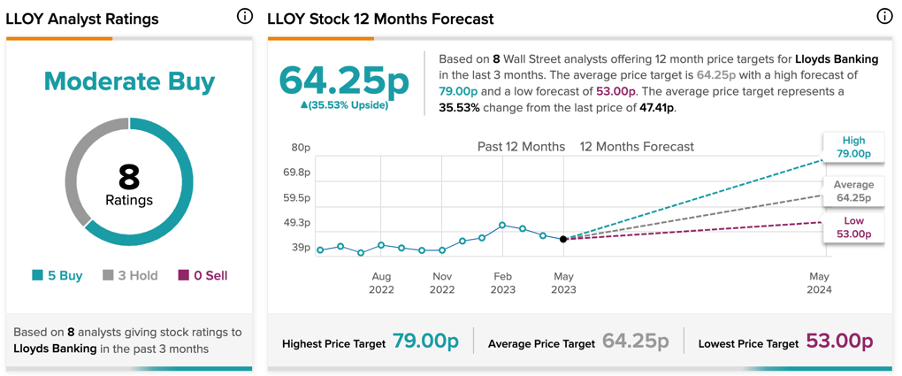

What is the Future for Lloyds Share Price?

LLOY stock has a Moderate Buy rating on TipRanks, backed by a total of eight recommendations, of which five are Buy.

The average price prediction for the next 12 months is 64.25p, which implies an upside of 35.53% from the current level.

Conclusion

These companies have been favored by income investors due to their generous dividend payments. At present, Lloyds Banking appears to be more suitable for investors seeking both dividend growth and capital appreciation.

Both of these stocks have received a Moderate Buy rating from analysts. When it comes to capital growth, Lloyds is anticipated to experience significant growth of 35%, while Barratt has the potential for a 6% increase in value, according to analysts’ predictions.