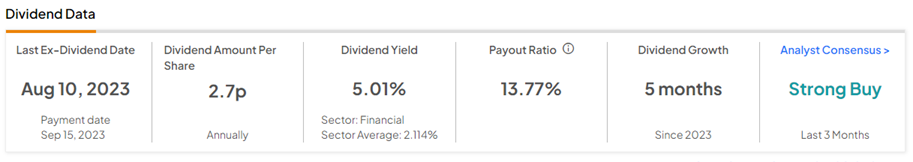

FTSE 100-listed Barclays PLC (GB:BARC) is a wholesome stock offering attractive total returns, including both dividend and stock price appreciation. The bank has a lucrative dividend yield of over 5%, significantly higher than the sector average of 2.1%. Moreover, analysts are highly bullish about the stock’s trajectory and expect a meaningful upside potential over the next twelve months.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Barclays is a London-based universal bank offering a wide range of services including current accounts, mortgages, savings and investment management services, credit cards, and business banking services to retail clients and corporates. Barclays paid its most recent semi-annual dividend of 2.70p per share on September 15, 2023.

Barclays Balances Between Cash Returns and Investment

Barclays’ board believes in maintaining an appropriate balance between returning cash to shareholders and investing in the business. The bank aims to follow a progressive dividend policy. Its full-year 2022 dividend of 5.0p per share was higher than the 2021 figure of 4.0p per share. During the pandemic, Barclays had paused its dividend payments. However, the bank resumed its dividends in early 2021 by paying a dividend of 1.0p for the full year 2020 and has steadily reached its pre-pandemic levels.

Moreover, the bank believes in supplementing the common stock dividends with share buybacks, thus reducing the overall float of the shares. Barclays completed its recently announced £750 million share buyback programme on October 23, 2023.

Meanwhile, the bank is implementing several measures to improve its profitability. It is reportedly mulling job cuts and other steps to generate cost savings of £1 billion.

Is Barclays a Buy, Sell, or Hold?

On TipRanks, BARC stock commands a Strong Buy consensus rating based on nine Buys and one Sell rating. The Barclays PLC share price target of 215.00p implies 38.8% upside potential from current levels.