Pharma companies GlaxoSmithKline (GB:GSK) and AstraZeneca (GB:AZN) will report their first-quarter earnings for the fiscal year 2023 this week. Ahead of the results, GSK has a Hold rating from analysts, while AZN has a Moderate Buy rating.

Here, we have used the TipRanks Earnings Calendar to screen these stocks with upcoming earnings dates. The tool includes updated information about the companies’ earnings date, forecasted EPS, analyst consensus, etc.

Let’s take a look at the details.

GSK PLC

GlaxoSmithKline, or GSK, is a global pharmaceutical company well-known for its diverse portfolio of vaccines.

GSK will report its results for Q1 2023 on Wednesday, April 26. According to analysts’ consensus, the forecasted EPS is 0.33p per share, which is similar to the EPS of the same quarter in the previous year.

Overall, analysts expect lower revenues and earnings for the company as compared to the high figures of Q1 2022, driven by COVID-19 vaccines. The company has already stated that it is not expecting any COVID-related revenues or profits in 2023. The expected revenues for the quarter are £6.49 billion, which is 33.5% down on a year-over-year basis.

Is GSK a Good Share to Buy?

GSK stock has a Hold rating on TipRanks based on a total of 12 recommendations. It includes four Buy, six Hold, and two Sell ratings.

The average price target is 1,584.09p, which is 7.4% higher than the current trading levels.

AstraZeneca PLC

GSK’s competitor, AstraZeneca, gained huge success with its successful launch of COVID-19 vaccines. Over the last three years, the stock has traded up by 57%.

AstraZeneca will report its first-quarter earnings on April 27. The consensus EPS forecast is 1.37p per share on TipRanks, lower than the EPS of 1.89p in Q1 of 2022. The sales forecast for the quarter is £8.57 billion.

The company’s product pipeline for 2023 is impressive, which could lead to higher revenues. However, analysts are awaiting further updates on its drug trials in its upcoming results.

13 days ago, analyst Emily Field from Barclays reiterated her Buy rating on the stock at a price target of 13,500p. She also raised her EPS forecast for 2023 based on the company’s deal with Sobi and Sanofi to sell its drug Nirsevimab in the U.S.

What is the Future of AstraZeneca Stock?

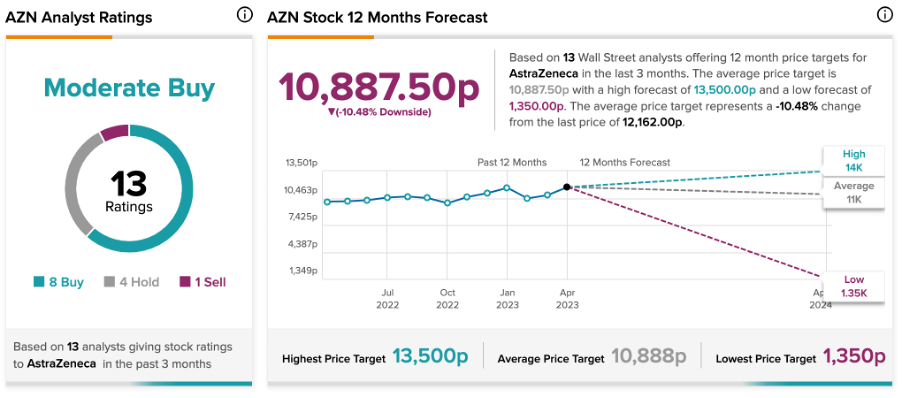

Analysts remain cautiously bullish on the AZN stock and don’t predict any significant upside to the share price. The stock has a total of 13 recommendations on TipRanks, of which eight are Buy.

The average price target is 10,887.5p, which is 10.4% lower than the current price.

Conclusion

Both GSK and AZN delivered solid results in 2022, and analysts expect lower numbers for the first half of 2023. In terms of share price growth, GSK has around 7% potential upside, while AZN is currently trading at a higher level than the price target.