ASX-listed Woodside Energy Group Ltd. (AU:WDS) averted the strike at its natural gas plants after signing an agreement with its workers, stabilizing the global gas markets. The agreement effectively resolved a looming strike that had the potential to disrupt the global gas supply chain and trigger elevated energy costs across the globe. The decision came after prolonged negotiations between Woodside and union representatives.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company’s workers had expressed intentions to initiate a strike due to various concerns, including compensation. Such announcements have fueled instability in natural gas prices, particularly in European nations, along with global supply issues.

While the agreement is still pending finalization, it signifies a noteworthy stride toward achieving stability within the global gas market. The Woodside facilities, along with those managed by Chevron Corporation (NYSE:CVX) in Australia, collectively contribute to over 10% of the global LNG supply. Therefore, preventing a strike alleviates worries related to possible supply interruptions and aids in curbing price fluctuations. Chevron is still pursuing an arrangement like this with its workers and is hoping for an outcome that is advantageous for all parties involved.

Following the news, Woodside Energy stock gained 1.1% during today’s trading session.

The deal news came just after the company announced its half-year earnings earlier this week on Monday with record production and profit numbers. The company delivered a first-half net profit after tax of $1.7 billion, up by 6.1% compared to the same period in 2022.

Woodside Energy is the largest oil and gas company in Australia that carries more than 35 years of experience in the sector. The company has projects in Australia, Mexico, and Trinidad and Tobago.

Is Woodside Energy a Buy or Sell Stock?

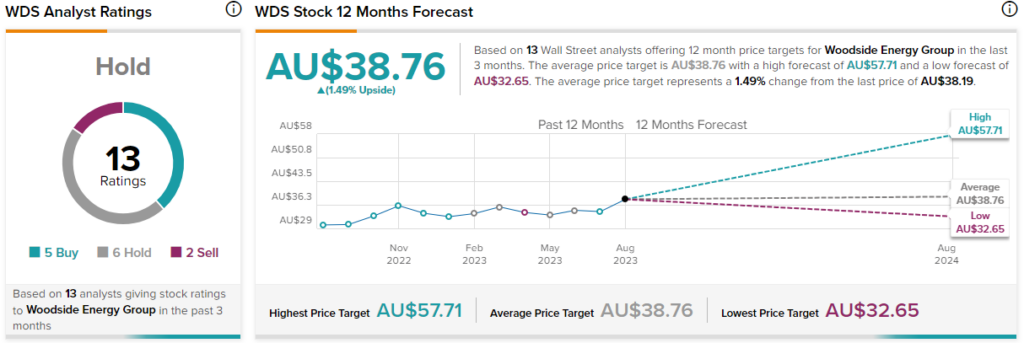

Today, analyst Adrian Prendergast from Morgans reiterated his Hold rating on the stock, predicting downside potential of 12.2%.

Overall, analysts are cautious about WDS stock, as evident by its Hold rating on TipRanks. The consensus is based on five Buy, six Hold, and two Sell recommendations. At an average target price of AU$38.76, analysts predict modest gains of 1.5% from current levels.