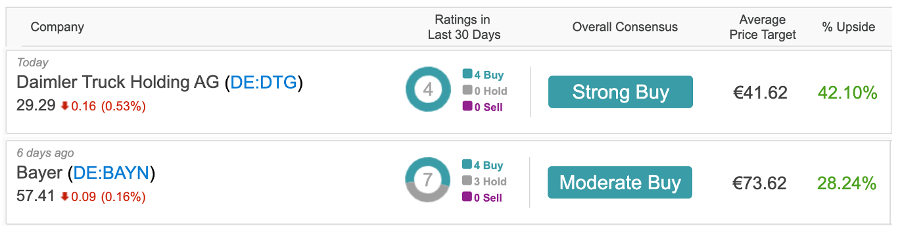

Analysts have rated vehicle manufacturer Daimler Truck Holding AG (DE:DTG) and pharmaceutical company Bayer AG (DE:BAYN) from the DAX 40 index as a Buy. The analysts are impressed by the stable numbers in their results and expect the momentum to continue.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Using the TipRanks Trending Stocks tool for Germany, we found out that these stocks have been recently rated or upgraded by analysts. This tool lists all the stocks in a particular market that have been rated by analysts during the last 30 days. We can also filter this list based on market capitalization and the sector the company operates in.

Let’s discuss these German stocks in detail.

Daimler Truck Holding AG – Higher Demand for Vehicles

Based in Germany, Daimler is a commercial vehicle manufacturer that was split off from the car-making company Mercedes-Benz Group (DE:MBG). Daimler began trading as a separately listed company in December 2021.

Since then, the stock has been trading down by 0.84%. In the last six months, the stock has gained 19.12%, driven by a favorable performance with stronger demand for its trucks and higher pricing.

The company witnessed a big increase of 159% in its third-quarter earnings before tax of €1.28 billion. The analysts were expecting this number to be around €1.1 billion. The total revenue in the quarter increased by 47% to €13.5 billion. The analysts are bullish that with higher demand and a strong order backlog, the company will achieve its target of full-year revenue of €50-€52 billion.

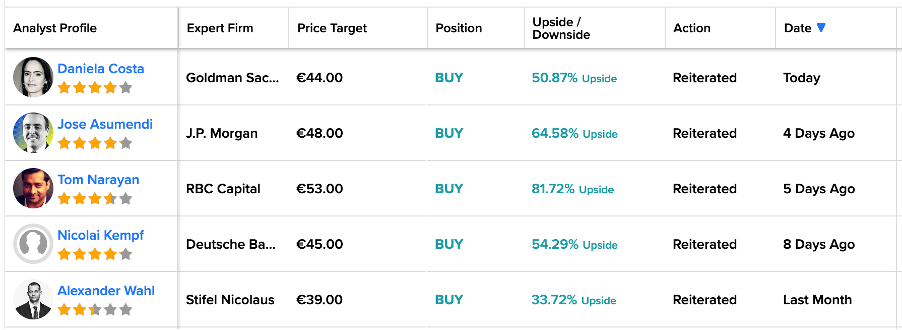

The stock has wide coverage from high-rated analysts. Most recently, Goldman Sachs analyst Daniela Costa has reiterated her Buy rating on the stock. She has increased the target price from €42 to €44, which shows an upside of 50%.

Costa has a 90% success rate on the stock, with an average return of 10.8%.

Is Daimler a Good Stock to Buy?

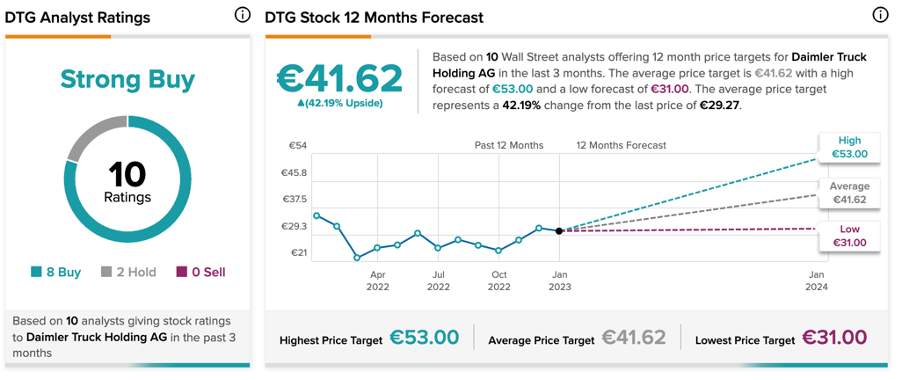

According to TipRanks’ analyst consensus, Daimler stock has a Strong Buy rating.

The DTG average target price is €41.6, which is 42% higher than the current trading price of €29.28.

Bayer AG – Strong Pipeline of Drugs

Bayer, as a biotechnology company, operates in three business areas: pharmaceuticals, consumer health, and crop science.

In its recent results for the third quarter of 2022, the company posted better-than-expected numbers. The sales increased by 15.3% to €9.7 billion, driven by higher crop science sales in Latin America and Europe. The company’s earnings before interest and tax were up by 17.3% to €2.5 billion.

Moving forward, the company is highly optimistic about its new drugs. The company sees its four new drugs as a €12 billion sales opportunity. This includes the prostate cancer drugs Nubeqa and Kerendia for kidney issues, which are already making good progress.

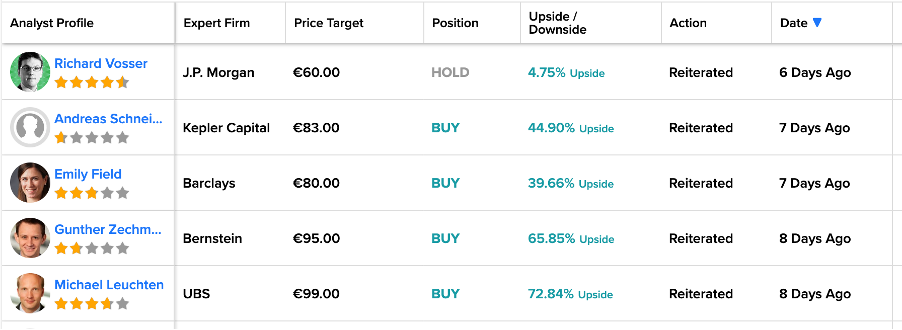

The stock has seen a lot of action in the last few days, with a majority of Buy ratings. UBS analyst Michael Leuchten has one of the highest target prices on the stock at €99.0, which has an upside potential of 72.8%.

Will Bayer Stock Go Up?

The BAYN target price is €73.62, which shows a potential increase of 28% on the current price level.

Bayer stock has a Moderate Buy rating on TipRanks, based on nine Buy and five Hold recommendations.

Conclusion

Analysts are bullish on these companies, considering the future demand for their products, which ensures the stability of their revenues.